HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Tinghua Duan | Frank Weikai Li | Hong Zhang

Do Carbon Pricing Policies Harm Firm Performance? Worldwide Evidence

Aug 6, 2025

Key Takeaways

- This study examines whether carbon pricing policies adversely affect profitability, market valuation, investments, and employment of publicly listed firms worldwide.

- Results show no evidence that carbon pricing reduces aggregate profitability, investment, or employment in jurisdictions that implement such policies.

- Instead, carbon pricing reallocates profits and investments from firms with high emission intensity to those with low emission intensity.

- High-emission firms face declines in market value driven by reduced expected future cash flows and elevated discount rates, whereas low-emission firms experience value gains.

- The relative decrease in profitability for high-emission firms stems from a combination of slower sales growth and rising operating costs.

- Findings emphasize significant firm-level distributional consequences of carbon pricing and suggest important normative implications for climate policy design and corporate carbon efficiency.

Source Publication: Duan, T., Li, F. W., & Zhang, H. (2025). “Do Carbon Pricing Policies Harm Firm Performance? Worldwide Evidence.” SSRN Working Paper.

Background and Research Questions

The accumulation of greenhouse gases and their role in climate change present a pressing global challenge. Carbon pricing mechanisms—such as carbon taxes and emissions trading systems (ETS)—are widely recognized as effective tools to curb emissions. Yet, adoption of these policies remains low globally, largely due to concerns over potential negative economic effects on the economy and employment. Existing literature provides mixed evidence, often limited in geographic scope or firm-level detail.

This paper addresses these gaps by analyzing how carbon pricing initiatives enacted worldwide impact the profitability, market value, investment decisions, and employment of publicly listed firms. It further distinguishes aggregate effects at the jurisdictional level from distributional impacts based on firms’ emission intensities.

Data and Methodology

The empirical analysis combines several comprehensive data sources:

- Firm-level emissions: Data from S&P Global Trucost (2002–2019) covering Scope 1, Scope 2, and Scope 3 emission intensities.

- Carbon pricing policies: Regional, national, and subnational carbon pricing information obtained from the World Bank Carbon Pricing Dashboard (1990–2019).

- Financial and market information: Firm financial data are drawn from Worldscope and Compustat Global, whereas analyst forecast data come from I/B/E/S.

- Country-level controls: These controls include macroeconomic indicators, measures of legal institutions, energy-mix compositions, and physical climate risk metrics.

The final dataset consists of 104,100 firm-year observations, covering 16,222 firms across 52 countries from 2002 to 2019.

Exploiting the staggered introduction of carbon pricing policies across jurisdictions, the study employs a difference-in-differences (DiD) approach with a Post indicator for policy enactment to identify aggregate effects at jurisdiction level. To capture within-jurisdiction heterogeneity, a triple-difference (DDD) approach interacts the Post indicator with firm-level carbon intensity. This method contrasts changes over time between adopting and non-adopting jurisdictions and across firms with varying emission intensities. Outcomes of interest include firm profitability measures (ROA, ROE), firm valuation (Tobin’s q), investment proxies (capital expenditure, R&D, employment), analyst earnings forecasts, and costs of capital measures (debt and equity).

Findings and Discussion

The results reveal distinct aggregate and distributional effects of carbon pricing policies. At the aggregate jurisdictional level, no evidence that carbon pricing adversely affects overall firm profitability, investment, or employment emerges. Specifically, DiD estimates indicate a significant increase of 79 basis points in carbon-efficiency-weighted ROA for firms in jurisdictions adopting carbon pricing, while aggregate ROE, capital expenditures, R&Ds, and employment changes are statistically insignificant. These findings align with prior research reporting limited macroeconomic impacts of carbon pricing.

Conversely, the DDD analysis uncovers substantial redistribution effects within jurisdictions. The interaction between Post and firm-level carbon intensity is significantly negative for ROA and ROE, indicating carbon-intensive firms experience significant declines in profitability relative to low-intensity firms post-policy. Quantitatively, a one-standard-deviation increase in emission intensity is associated with a post-policy ROA reduction of 46.6 basis points (~11% of the mean) and an ROE decline of 118 basis points (~12.5% of the mean). This redistribution reflects a transfer of profits from carbon-intensive to less carbon-intensive firms.

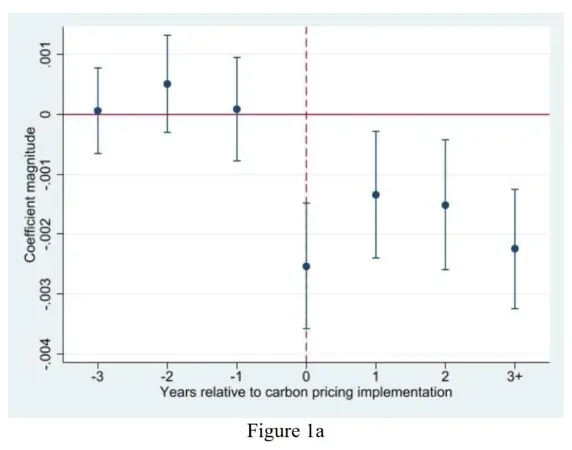

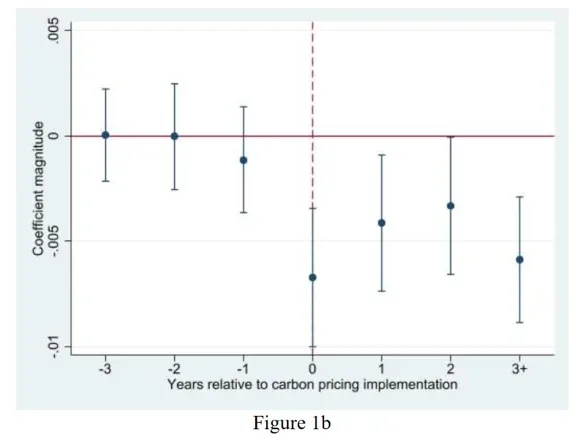

Figure 1 Dynamic effects of carbon pricing initiatives on firm profitability

Note: This figure plots the coefficient estimates of seven interaction terms between time dummies indicating years relative to the enactment of carbon pricing and Log(Intensity1+1). Figure 1a plots the dynamic effects of carbon pricing on ROA. Figure 1b plots the dynamic effects of carbon pricing on ROE. The 95% confidence intervals are based on standard errors clustered at firm level.

These shifts extend to firm valuation and investment. While aggregate Tobin’s q remains unchanged, carbon-intensive firms face notable value declines relative to their low-emission peers. This revaluation is driven by reductions in expected future cash flows—analyst EPS forecasts fall for three years post-policy—and increases in cost of capital measures, consistent with investors’ elevated concerns for climate regulatory risk rather than physical risk.

Investment reallocation is evident as carbon-intensive firms curtail capital expenditures, R&D expenses, and employment relative to low-intensity firms, despite negligible impacts for aggregate investment and employment levels. These dynamics suggest improved carbon efficiency in the allocation of physical and intangible capital.

Robustness checks confirm the financial redistribution effect is stronger with higher carbon prices. This pattern holds across carbon taxes and ETSs, is more pronounced in fossil-fuel-dependent economies, and remains unaffected by exposure to physical climate risks. The decline in profitability for high-intensity firms is driven by increased operating costs and weaker sales growth.

Policy or Market Implications

The findings highlight that carbon pricing policies primarily generate distributional impacts across firms, rather than imposing a uniform aggregate economic cost on firms. This nuance is critical for policymakers concerned about social and economic consequences of climate policies. The absence of negative aggregate effects suggests fears of broad economic harm may be overstated. However, the observed redistribution from carbon-intensive to carbon-efficient firms signals a need to address the social costs borne by the most affected stakeholders.

These results advocate for complementary fiscal interventions to alleviate economic burdens on vulnerable firms and workers, thereby supporting the political feasibility and social acceptability of carbon pricing initiatives. Moreover, the market’s differential valuation and investment response to carbon pricing underscores its role in incentivizing corporate decarbonization and enhancing carbon efficiency over time.