HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Ye Zhang | Eric Zou

ESG Aversion: Experimental Evidence on Perceptions and Preferences

Oct 9, 2025

Key Takeaways

- Research Question: Do startup founders and VC investors consider ESG characteristics important when choosing partners? If so, do they value ESG because they believe it affects their future financial performance, or because they have an intrinsic preference for ESG?

- Data & Method: A two-sided field experiment with 409 founders and 129 VCs in the US combines randomized profile evaluations with a willingness-to-pay task to disentangle belief- and taste-based ESG demand.

- Findings: ESG-labeled profiles receive significantly less interest—especially those with environmental attributes—revealing a sizable “ESG penalty.”

- This aversion is mainly driven by beliefs that ESG partners might hurt profits and are harder to engage with.

- When performance concerns are held constant, a latent pro-ESG preference emerges: founders are 32% more likely, and VCs are over twice as likely, to pay for ESG-oriented match suggestions.

- Implications: Performance concerns, not preferences, drive ESG avoidance. Addressing these gaps could help unlock suppressed demand for sustainable collaboration.

Source Publication: Zhang, Ye, and Eric Zou, (2025) “ESG Aversion: Experimental Evidence on Perceptions and Preferences.” SSRN Working Paper.

The ESG Debate

Although ESG investing has gained global momentum, its reception remains contested. Proponents argue ESG strategies foster long-term value and risk mitigation. Skeptics worry ESG distracts from financial fundamentals or imposes costly mandates. Amidst this debate, a critical question arises: Do markets really value ESG? And if so, do they value it because it enhances firm value, or because market players value sustainability for its own sake (i.e., the “value versus values” question) To tackle this question, the study introduces a carefully designed experiment in the VC market that disentangles belief-based (financial) and taste-based (non-financial) motives for ESG engagement.

Experimental Design: Mapping Perceptions and Preferences

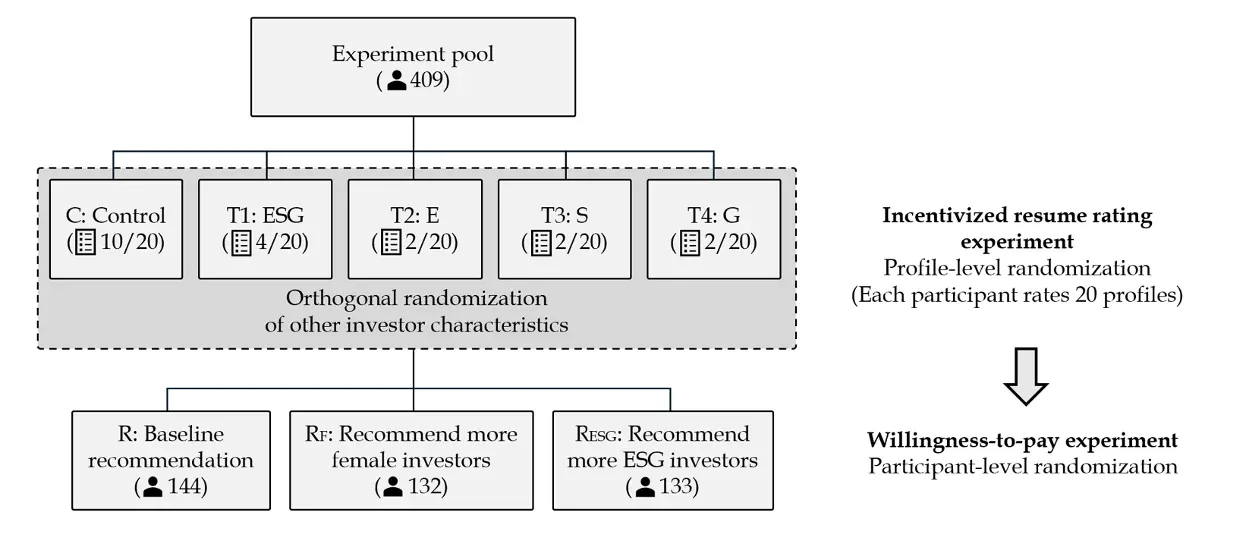

The study recruited 409 startup founders and 129 venture capitalists across the US. Each participant completed two modules. In the first, they evaluated hypothetical partner profiles, some of which were randomly labeled as ESG-focused. This random assignment allowed the researchers to estimate the causal effect of an ESG label on expressed interest. Participants understood their responses would help generate actual match recommendations, introducing real-world stakes into the evaluation process.

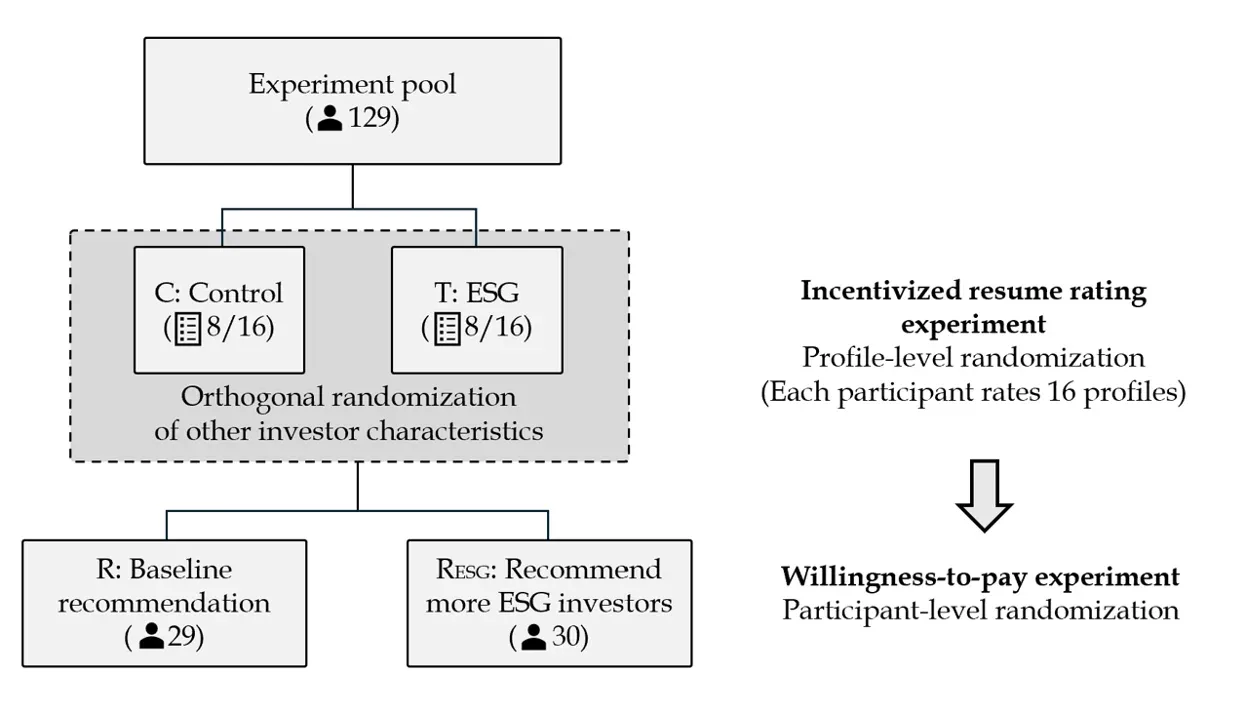

In the second module, participants faced a willingness-to-pay task. They were offered the option to forgo part of a lottery-based reward in exchange for additional ESG-oriented match suggestions. Importantly, the study described these additional recommendations as being identical to the standard set in match quality. By holding expected performance constant, this design isolates taste-based preferences for ESG from any belief-based concerns about profitability or feasibility.

Figure 1. Experimental Design

A. Startup Experiment

B. VC Investor Experiment

Notes: This figure outlines the startup-side experiment (panel A) and the VC investor-side experiment (panel B). Both begin with a profile-level randomization stage, where participants evaluate a fixed number of randomized profiles featuring various ESG types (e.g., control, ESG, E, S, G). This step is followed by a willingness-to-pay experiment, where individuals are offered a choice to forgo part of the lottery award in exchange for additional recommendations of potential matches. Offers are randomized at the individual level: some participants expect to receive standard recommendations, while others expect to receive more ESG-aligned recommendations. In panel B, the willingness-to-pay module is implemented among 59 investors recruited in a later stage of the study. The remaining investors recruited earlier participated only in the resume-rating task.

A Hidden Penalty—and a Hidden Preference

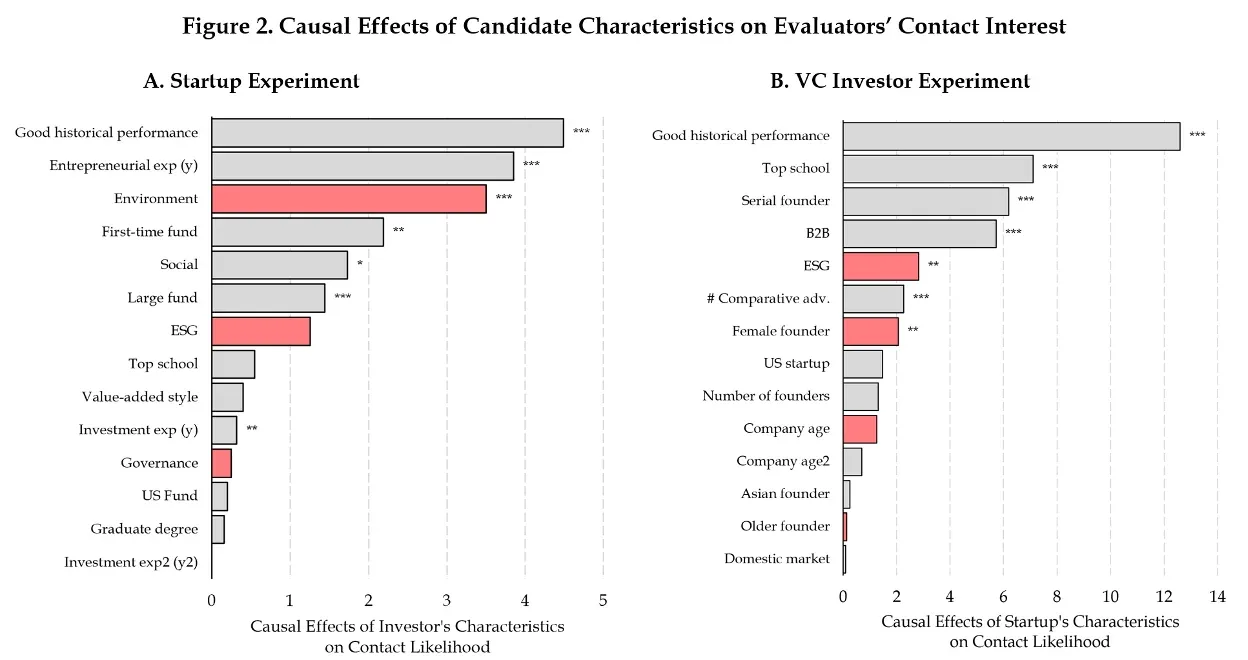

The results reveal a striking ESG penalty. Profiles randomly labeled with ESG attributes were significantly less likely to receive positive interest. On the startup side, founders were about 5.7% less likely to engage with an ESG-oriented investor than with an otherwise identical, profit-focused counterpart. On the investor side, VCs showed a 5.4% reduction in interest toward ESG-emphasizing startups. This aversion was most pronounced when the profile highlighted environmental goals. The economic significance of this effect was comparable to meaningful real-world differences—for example, the penalty was roughly equivalent to the disadvantage of a VC lacking entrepreneurial experience or half the benefit conferred by a top-tier education for a founder.

Notes: This figure reports regression coefficients for the effect of various candidate characteristics on evaluators’ contact interest, ordered by absolute effect size. Red bars represent negative effects, and gray bars indicate positive effects. Panel A shows results from the startup experiment, where startup founders evaluated VC investor profiles. Panel B shows results from the VC investor experiment, where investors evaluated startup profiles. ∗: p < 0.10, ∗∗: p < 0.05, ∗∗∗: p < 0.01.

Importantly, the aversion stems primarily from performance-related beliefs. Founders rated ESG investors lower in expected profitability and accessibility. Environmental investors, in particular, were rated 3.17 points lower on perceived profitability and 3.40 points lower on likelihood of engaging in a match. These perceptions were echoed in a follow-up survey, where participants expressed concern that ESG collaboration might entail costly mandates or lack serious follow-through. Greenwashing concerns also surfaced as potential sources of skepticism.

Yet, when performance concerns were neutralized, an opposite pattern emerged. In the willingness-to-pay module, participants demonstrated a clear preference for ESG. Founders were 32% more likely to pay for extra ESG-oriented match recommendations, and VCs were more than twice as likely to do so relative to baseline. The implied monetary value of these ESG-preferred lists was substantial: approximately $77 for founders and $187 for VCs—figures aligned with market rates for paid matching services. These results reveal a latent, non-pecuniary preference for ESG that is masked under ordinary circumstances by concerns about financial tradeoffs.

Interpreting the Tension: Performance or Principle?

Taken together, the findings suggest the observed aversion to ESG is not a rejection of environmental or social values. Rather, it reflects skepticism about ESG’s compatibility with financial performance. Once these concerns are removed, personal values—altruism, social mission, and environmental consciousness—become salient. Participants were not indifferent to ESG; they were cautious and perhaps constrained by beliefs about market realities.

This interpretation is reinforced by behavioral correlations. Participants who rated ESG profiles more favorably were also more likely to donate to ESG-related NGOs. Similarly, real-world fundraising behavior and matching outcomes aligned with the experimental results, strengthening external validity.

Implications for Policy and Practice

This study shows much of the observed ESG aversion in venture capital reflects concerns about profitability and partner engagement, rather than an outright rejection of ESG principles. These concerns—whether accurate or not—shape decision-making and may lead to the underrepresentation of ESG-oriented collaborations in the startup ecosystem. Efforts to provide clearer, credible evidence on the financial performance and operational reliability of ESG-aligned firms could help market participants make more informed choices.

Beyond improved information, complementary interventions, such as performance-linked ESG incentives, targeted investment vehicles, or policy frameworks that lower the perceived tradeoff between sustainability and returns, may help bridge this gap. In this way, the venture capital market could better match capital with high-impact, sustainability-driven opportunities without compromising economic objectives.