HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Maxime Couvert

What Are the Firm Value Implications of SEC-Challenged Shareholder Proposals?

Nov 27, 2024

Key Takeaways

- In the US, shareholders may submit proposals to the companies in their portfolio, requesting the implementation of various ESG reforms. These proposals are then put to a shareholder vote.

- However, managers may challenge these proposals at the SEC to have them excluded or negotiate with sponsors to have them withdrawn. Therefore, about half of these shareholder proposals never reach the voting stage.

- The paper examines the firm value implications of these non-voted proposals.

- Event-study results on exclusion and withdrawal announcements reveal non-voted proposals have a value-destroying nature.

- The harmful character of non-voted proposals stems from special interest investors such as NGOs, labor unions, or religious groups pursuing self-serving agendas and from corporate gadflies advocating for ill-suited reforms.

- Overall, the SEC challenge benefits firm value by filtering out harmful shareholder proposals.

Source Publication:

Maxime Couvert, 2024. What Are the Firm Value Implications of SEC-Challenged Shareholder Proposals? Management Science.

Background and Research Questions.

Shareholder proposals are one of the main tools for shareholders to influence the ESG policies of their portfolio firms. Whereas most of the literature has focused on proposal votes and shown voted proposals generate value when they pass, Couvert (2024) reveals about half of the proposals that firms receive never reach the voting stage. The reason is that management can request their exclusion at the SEC or negotiate with proposal sponsors to obtain proposal withdrawals. This selection process raises many questions: Why do managers challenge and negotiate proposals? What is the role of the SEC in the shareholder proposal process? Do the SEC’s regulatory enforcement actions benefit shareholders or managers, and why? Couvert (2024) provides a comprehensive analysis of these questions.

Data and Method

To answer the above question, the study constructs a novel dataset of challenged shareholder proposals from SEC no-action letters, which announce both the SEC’s exclusion decisions and the sponsors’ withdrawal decisions. This unique dataset allows for a detailed examination of the shareholder proposal process. The main research method consists of event studies at different key moments of the shareholder proposal process—namely, when firms challenge proposals at the SEC, when the SEC publishes a no-action letter, and when a challenged proposal is ultimately voted on. Studying the market reaction to these events and the characteristics of proposal sponsors and topics allows for determining who benefits from non-voted proposals and provides insights into the effectiveness and implications of the SEC’s role in the shareholder proposal process.

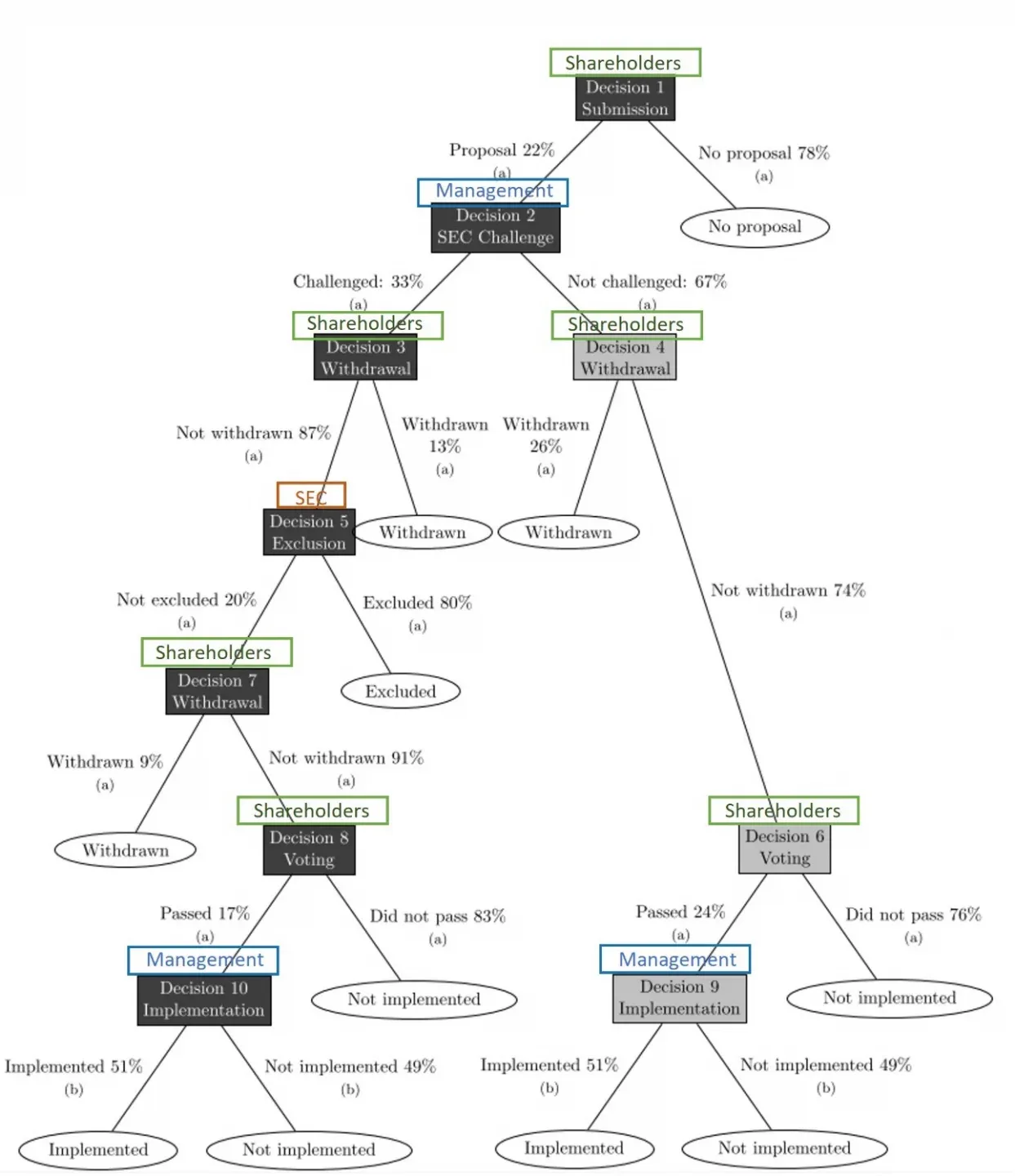

Figure 1. Shareholder Proposal Process

Results

First, the study provides descriptive evidence on the shareholder proposal process, as shown in Figure 1. In particular, it finds almost half of all proposals never reach ballots.

Moreover, the event-study results for excluded proposals reveal that, on average, markets react positively when the SEC makes exclusion decisions, suggesting such proposals, if implemented, harm firms. The positive reaction is notably larger when the SEC excludes proposals that were likely to win a majority of shareholder votes. Moreover, the study finds markets react negatively to withdrawal announcements, also suggesting these proposals, on average, have a value-destroying nature.

The study identifies two main reasons to explain the harmful nature of challenged proposals. First, sponsors use the shareholder proposal system to extract private benefits, as seen particularly in settlements with special interest investors such as labor unions, NGOs, and religious groups. Second, small retail investors, often referred to as “corporate gadflies,” file proposals that are not suited to the firms’ needs and therefore destroy firm value.

In the final part of the study, Couvert (2024) examines challenged proposals that manage to reach the voting stage. The analysis reveals shareholder support for these proposals is often significant. However, when these challenged proposals pass, they destroy, on average, 2% of firm value.

Implications

Couvert (2024) extends the existing literature on shareholder proposals and their wealth effects, revealing these proposals can have value-destroying implications. This finding diverges from earlier literature, which primarily points to positive value implications, thereby implying shareholder proposals are inherently diverse in terms of their value implications. It also underscores the SEC’s pivotal role in filtering out potentially harmful proposals that might otherwise be implemented after gaining majority shareholder support. In doing so, the study offers new evidence that regulatory enforcement actions can alleviate the adverse effects of enhancing shareholder rights. However, the findings also show the SEC’s challenge process isn’t entirely effective in preventing damaging proposals from destroying firm value.

The study also contributes to the broader understanding of the benefits and costs associated with shareholder empowerment. In particular, it adds to the ongoing debate regarding the reform of the shareholder proposal system by providing new empirical evidence on the negative effects of enhanced shareholder rights. It also outlines the economic mechanisms through which shareholder proposals can harm firm value, such as by empowering special interest investors and uninformed shareholders.