HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Irena Kustec | Charlotte Ostergaard | Amir Sasson

Underperformance in Family Successions: The Role of Outside Work Experience

May 28, 2025

Key Takeaways

This paper examines why family firms often perform worse after a CEO succession, despite seemingly high alignment of incentives.

The authors show nearly half of all family successors have never held a full-time job outside the family firm.

These internally groomed successors drive no measurable improvements in firm performance after succession.

By contrast, family successors with outside labor market experience perform similarly to unrelated, professional CEOs.

The findings point to a critical mechanism: outside experience helps successors build leadership capital they cannot develop within the family firm alone.

Source Publication:

Kustec, I., Ostergaard, C., & Sasson, A. Underperformance in Family Successions: The Role of Outside Work Experience. SSRN Working Paper

Background and Research Focus

The intergenerational succession of leadership is a defining moment for family-controlled firms. The received wisdom has long emphasized the unique strengths of family successors—deep firm-specific knowledge, personal investment in the business, and a commitment to long-term value. And yet, a persistent puzzle remains: empirical evidence often shows family CEO successions are associated with underperformance.

This paper shifts the lens away from questions of family control versus professional management, and toward a more nuanced distinction: how the successor’s prior career shapes their ability to lead. Rather than treat succession as a binary event—family versus non-family—the authors focus on whether heirs have developed leadership skills through prior exposure to the external labor market. Their central claim is that internally groomed successors often inherit authority before they have earned cognitive diversity, and this lack of external experience is a key contributor to post-succession stagnation.

Data and Methodology

Drawing on matched employer-employee data from Norway, the authors construct a comprehensive dataset of over 2,300 family-controlled firms that underwent a CEO succession between 2005 and 2010. These firms are defined by stable family ownership—at least one-third of equity held by a single family before and after the transition. The administrative data provide rare insight into the full career histories of individual CEOs, allowing the authors to distinguish between successors who worked outside the family business prior to appointment and those who did not.

The empirical strategy uses a stacked difference-in-differences framework to estimate the causal impact of succession on firm performance, measured as operating return on assets (OROA). The identification design accommodates staggered treatment timing and includes firm fixed effects to absorb time-invariant heterogeneity. Event-study plots validate the common trends assumption and show no pre-trends.

Findings

What emerges is a striking pattern: nearly half of all family successors have never held a full-time job outside the family firm. This insularity is not merely anecdotal—it appears systematic and consequential. Firms led by such internally groomed successors experience no measurable improvement in performance post-succession. In some cases, performance stagnates or declines.

By contrast, when family successors have held external positions—often in unrelated firms or sectors—their firms perform comparably to those led by unrelated, professional CEOs. This performance gap persists even after controlling for observable traits such as education, gender, and whether the outgoing CEO continues on the board after succession. Importantly, externally experienced successors are more likely to initiate strategic organizational changes after taking office, suggesting a more diverse skillset acquired in business environments that are different from the family firms they take over.

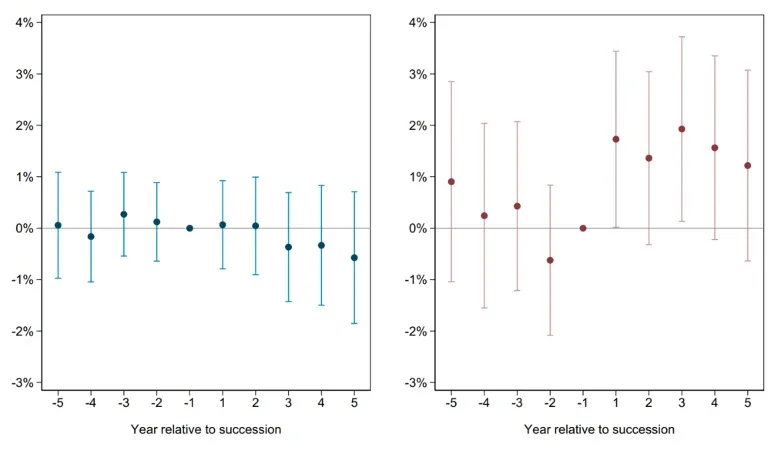

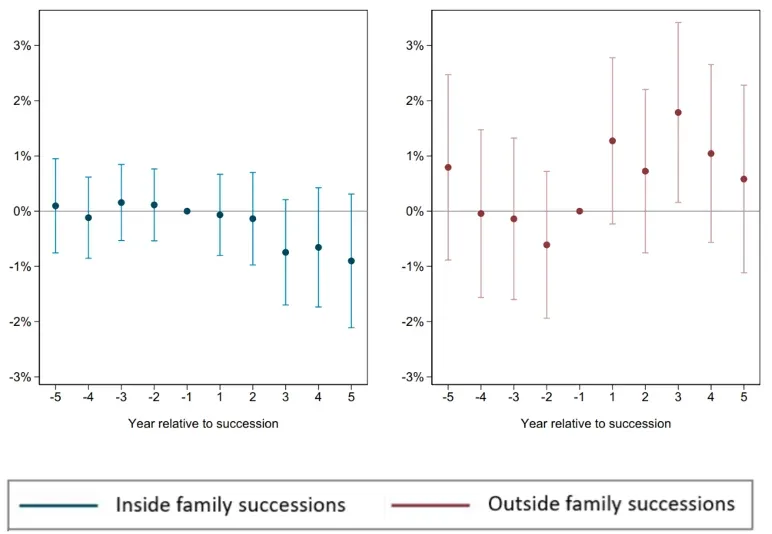

Figure 1 Event-study estimates of corporate performance around CEO successions

(a) OROA

(b) ROA

Note: The figure displays the point estimates and standard errors from dynamic treatment-effects regressions as in Sun and Abraham (2021). The left-hand-side panel (blue) introduces time-varying treatment effects for firms that undergo inside family successions while retaining post-succession dummies for outside and unrelated succession firms, fixed effects, and pre-treatment time-varying covariates. The right-hand-side panel (red) introduces time-varying treatment effects for firms that undergo outside family successions in a similar manner.

Implications

These results suggest strategic capabilities—acquired through exposure to diverse organizations, competitive environments, and external networks—cannot be cultivated solely through internal grooming. Although internal promotion preserves firm-specific knowledge, it may limit the development of broader strategic capabilities.

The findings imply succession planning in family firms should focus more on structured external experience. Requiring potential heirs to work outside the firm early in their careers, or encouraging temporary departures, may help equip them with the skills and legitimacy necessary for effective leadership.

Ultimately, the question is not whether the next CEO is a family member, but whether they have been forged by experience or merely appointed by inheritance.

Reference

Sun, L., & Abraham, S. (2021). Estimating dynamic treatment effects in event studies with heterogeneous treatment effects. Journal of econometrics, 225(2), 175-199.