HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Thomas W. Bates | David A. Becher | Jared I. Wilson

Under Pressure: The Increasing Turnover-Performance Sensitivity for Corporate Directors

May 6, 2025

Key Takeaways

This study explores a critical shift in corporate governance: the growing responsiveness of corporate director turnover to firm performance over the period from 2003 to 2019.

The likelihood of corporate director turnover following poor stock performance has risen dramatically over the past two decades, from 15% in the mid-2000s to 26% by the late 2010s, aligning it more closely with CEO turnover sensitivity.

This change can be attributed to reforms such as the introduction of independent board leadership, the establishment of independent nominating committees, greater director mobility, and the increased influence of institutional investors.

The findings suggest significant consequences for director career paths, compensation, and board accountability. Directors are now under heightened pressure to perform, with major implications for their professional future and the strategic direction of firms.

Source Publication:

Bates, Thomas W., Becher, David A., and Wilson, Jared I. “Under Pressure: The Increasing Turnover-Performance Sensitivity for Corporate Directors.” SSRN Working Paper

Rethinking Accountability on the Board

For decades, corporate directors have played a pivotal yet often opaque role in shaping firm outcomes. Tasked with monitoring executives and protecting shareholder interests, directors have traditionally enjoyed a degree of insulation from performance-related consequences that CEOs do not. However, amid evolving norms of corporate governance and growing demands for board accountability, a fundamental shift may be underway.

This study investigates whether boards have become more responsive to performance shortfalls, by examining how director turnover correlates with firm stock returns over time. Drawing on a rich panel of more than 360,000 director-firm-year observations between 2003 and 2019, the authors assess whether poor performance increasingly triggers director exits, and if so, what governance mechanisms and market forces are driving this trend.

Data and Empirical Approach

The analysis uses proprietary data from the BoardEx database, encompassing nearly the full population of directors at U.S. publicly traded firms. The empirical strategy centers on linear probability models, where the likelihood of independent director turnover is modeled as a function of lagged firm performance, particularly whether the firm ranked in the bottom quartile of industry-adjusted stock returns.

To ensure robustness, the authors incorporate a host of director- and firm-level controls and explore continuous measures of stock performance as well as longer time horizons. Further analyses distinguish between firms with and without independent board chairs, consider the presence of independent nominating committees, and examine the effects of local director labor market conditions. Instrumental variable and difference-in-differences methods are employed to address endogeneity concerns.

The Erosion of Board Tenure Stability

The results reveal a dramatic increase in director turnover sensitivity to firm performance. In the mid-2000s, directors at poorly performing firms were only modestly more likely to leave than those at better-performing firms. By the late 2010s, however, the probability of turnover in these cases had nearly doubled. Notably, this heightened responsiveness is not confined to any single firm type—it is observed across the S&P 1500, regardless of firm size, industry, or board composition.

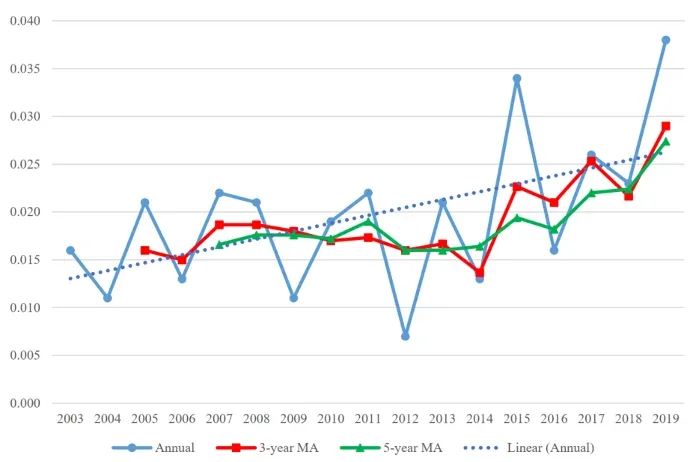

Figure 1: Turnover-Performance Sensitivity over Time

Note: The figure presents the annual estimates of director turnover-performance sensitivity from the linear probability model regression from 2003 to 2019.

This escalation in turnover-performance sensitivity effectively closes the historical gap between directors and CEOs in terms of job security linked to firm outcomes. While CEO turnover-performance sensitivity remained relatively stable over the sample period, the director counterpart surged, suggesting an institutional reconfiguration of how accountability is distributed across corporate leadership.

The findings indicate a number of factors have contributed to this increase. Governance reforms, such as the mandatory implementation of independent board chairs and nominating committees, have strengthened the accountability of directors. Furthermore, the rise in director mobility—facilitated by a more competitive and geographically expansive director labor market—has enabled firms to more easily replace underperforming directors. The increased influence of institutional investors has also been pivotal, because these investors have become more active in demanding accountability from boards and individual directors, particularly in the wake of governance reforms such as proxy access.

Implications

The rise in turnover-performance sensitivity has profound implications for both corporate governance and the labor market for directors. As boards face increasing pressure to perform, directors are confronted with heightened risks to their tenure and compensation. This shift signals a larger trend in which directors are held more accountable for firm performance, similar to their CEO counterparts.

The findings also suggest governance reforms, such as the introduction of independent board leadership and the strengthening of institutional investor power, have made boards more effective in holding directors accountable. As shareholder scrutiny continues to grow, particularly with the rise of proxy access and other governance reforms, directors are likely to face even greater pressure to ensure firm performance meets expectations.

The increased sensitivity of director turnover to poor performance also raises important questions about the long-term impacts on director behavior. Will directors become more risk averse, focusing on short-term performance metrics to safeguard their tenure? Or will the increased accountability encourage bolder, more strategic decisions in the long run?

Finally, the narrowing gap between CEO and director turnover-performance sensitivity has broader implications for how boards function. Because directors are now facing pressures similar to those experienced by CEOs, considering how this convergence might affect the balance of power and decision-making within the boardroom is essential.