HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Yildiray Yildirim|Jian Zhang|Bing Zhu

Opioid Crisis and Local Economic Pain: Evidence from Commercial Real Estate Loan

Mar 24. 2025

Key Takeaways

- This research investigates the local economic impacts of the opioid epidemic by examining the performance of commercial real estate (CRE) loans.

- The study explores exogenous variations with various identification strategy, such as IV analysis using primary physicians per capita and Difference-in-differences based on state-level Opioid Misuse Prevention Legislation, to establish a causal link between opioid abuse and deteriorating CRE loan performance.

- Increased opioid abuse leads to a reduction in net operating income (NOI) and an increase in vacancies for commercial properties, resulting in higher loan default rates.

- These economic disruptions are primarily driven by declining business sales and decreased neighborhood desirability in opioid-affected areas. The effects are most pronounced in retail and residential properties and in regions with weaker economic conditions, larger minority and young populations, and Republican-leaning states.

- The findings suggest that public health crises like the opioid epidemic generate significant negative externalities for local financial markets, necessitating coordinated policy responses.

- State-level prescription drug monitoring programs (PDMPs) are shown to be effective in mitigating the financial consequences of the opioid crisis, highlighting the importance of regulatory interventions.

Source Publication:

Yildirim, Yildiray, Zhang, Jian, & Zhu, Bing. (2024). Opioid Crisis and Local Economic Pain: Evidence from Commercial Real Estate Loan. SSRN Working Paper, https://dx.doi.org/10.2139/ssrn.5077758.

Background and Research Question

The opioid epidemic in the United States has become one of the most severe public health crises, causing devastating economic and social consequences. While researchers have extensively studied its effects on public health, labor markets, and municipal finances, this study examines its impact on commercial real estate (CRE) mortgage performance.

This paper investigates how the opioid epidemic affects commercial real estate loan performance. By analyzing the relationship between opioid distribution and mortgage delinquency rates, the study shows that opioid misuse undermines local economic stability, leading to financial distress in CRE markets.

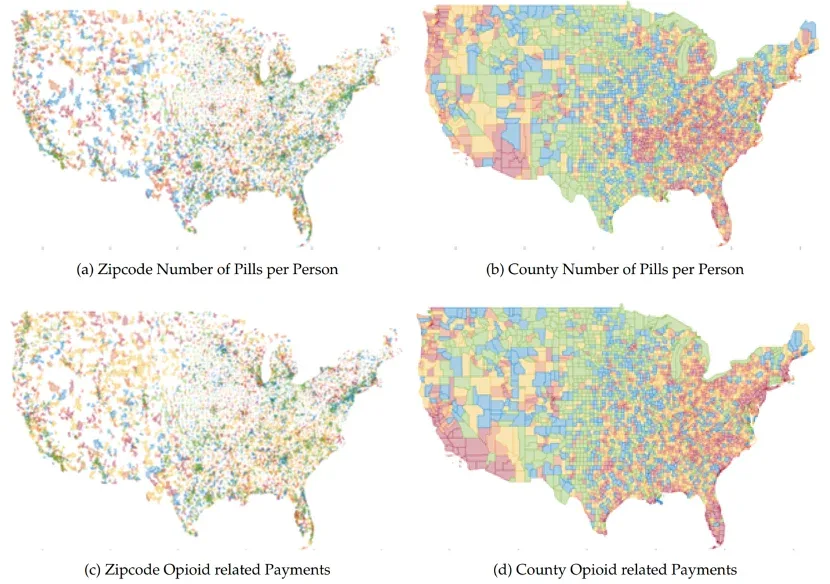

Figure 1 Opioid Abuse Proxies across the Nation

Note: Figure 1(a) and 1(b) presents the number of pills distributed per person at zipcode (Left) and County (Right) level. Figure 1(c) and 1(d) illustrates Physician Opioid related payments at the zipcode (Left) and County (Right) level. We classify these zip codes or counties into five quantiles, ranging from the 20% of zip codes with the lowest amount (Q1) to the 20% with the highest amount (Q5). The colors red, orange, yellow, blue, and green represent 20% of zip codes, with the highest (Q5) to the lowest (Q1).

Data and Methodology

This study integrates a unique dataset encompassing multiple sources. The loan-level data come from the Trepp database, which tracks commercial mortgage-backed securities (CMBS) from 2011 to 2019. To capture opioid distribution patterns, the study relies on the Drug Enforcement Administration’s (DEA) ARCOS system, which provides ZIP code-level data on opioid pill distribution. Local economic and demographic indicators are sourced from the Bureau of Labor Statistics (BLS), Data Axle, and the National Neighborhood Data Archive (NaNDA), offering insights into business sales, employment conditions, and neighborhood characteristics.

For causal identification, the study uses two approaches: an instrumental variable (IV) analysis that employs physician pharmaceutical payments to predict local opioid distribution, and a difference-in-differences (DiD) analysis that examines how prescription drug monitoring programs (PDMPs) affect mortgage delinquency. The findings’ robustness is verified through multiple checks, including varying opioid distribution metrics, delinquency thresholds, and geographic exposure ranges.

Findings and Discussion

The study presents robust evidence that higher opioid distribution leads to increased CRE mortgage delinquency rates. A one standard deviation increase in opioid pill distribution per capita within a ZIP code is associated with a statistically significant rise in the probability of loans becoming delinquent for over 60 days. This effect remains economically meaningful across multiple model specifications.

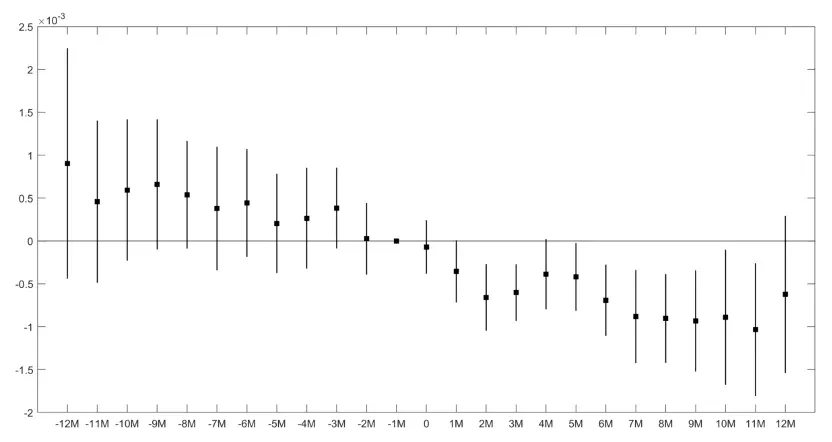

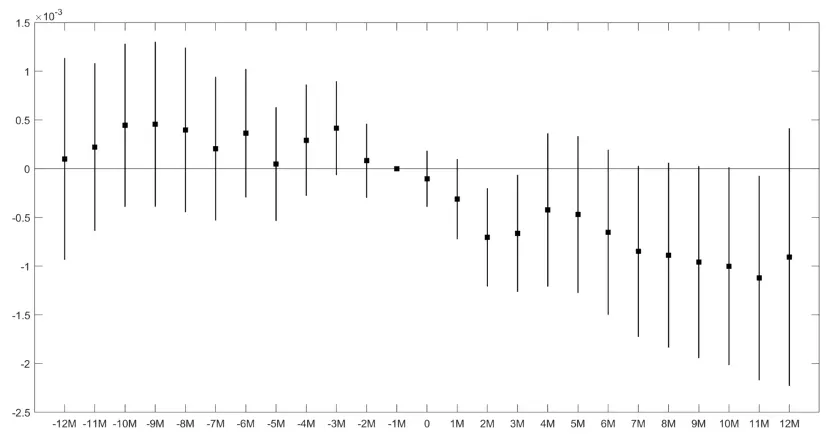

Figure 2 The Effect of Opioid Limiting Laws on Delinquency

(a) Dynamic TWFE Model

(b) Interacted Weighted Dynamic TWFE Model

Note: this graph illustrates the coefficients and 95% confidence interval for the variable of the years before and after the in-force of Opioid limiting laws on the mortgage delinquency rate. Treated and non-treated states are matched using propensity score matching with the nearest neighbors method. Control variables include Zipcode level employment number, business concentration (HHI of sectoral employment), zipcode level percentage of the disabled population, percentage of the population without health insurance, percentage of the population working less than 13 weeks per year, percentage of population below the poverty rate, median rent to income ratio, as well as property-level loan to value ratio at securitization, loan rate, loan term, income overstatement at securitization, and a dummy variable for interest only loan. The dummy variables for the construction year group, property type, state, deal type, and year are also included. Standard errors are clustered at the property-year level.

The negative impact of opioid abuse on CRE mortgage performance operates through two primary channels. First, opioid misuse erodes financial stability among households and businesses, reducing NOI and increasing vacancy rates in commercial properties. Second, opioid-affected areas experience economic slowdowns that weaken local demand for commercial spaces, particularly in the retail and multifamily housing sectors. These effects are most pronounced in retail and residential properties, which experience a direct decline in business activity and rental demand. By contrast, office and industrial properties show weaker relationships with opioid distribution.

Regional disparities further shape the extent of mortgage delinquency. Areas with lower health insurance coverage, higher rental burdens, and fewer job opportunities exhibit more severe financial distress, amplifying the effects of opioid abuse. The study also finds that the impact is particularly significant in communities with larger minority and young populations. Notably, Republican-leaning states experience more pronounced effects, suggesting that policy and regulatory environments may play a role in shaping the local economic consequences of opioid misuse.

Policy and Market Implications

The findings emphasize that the opioid epidemic extends beyond public health concerns, imposing significant financial risks on local economies and real estate markets. Regulatory interventions such as state-level PDMPs appear to mitigate these risks. After the implementation of opioid-limiting laws, mortgage delinquency rates decline by approximately 19 basis points, reinforcing the effectiveness of policy interventions in stabilizing financial markets.

The commercial real estate credit market has already begun adjusting to the risks associated with opioid abuse. A one standard deviation increase in opioid distribution correlates with a 23 basis point increase in initial loan spreads, a 2.7% decrease in initial loan-to-value (LTV) ratios, and a 77.2% increase in debt service coverage ratios. These adjustments indicate that lenders are pricing opioid-related economic risks into their underwriting standards.

For policymakers, this study highlights the need for a coordinated approach that integrates public health interventions with economic stabilization policies. Addressing opioid abuse not only reduces public health burdens but also enhances financial stability at the local level. Neighborhood stabilization efforts, such as job training programs and business incentives, could help mitigate the spillover effects of opioid abuse on CRE markets.

Conclusion

This study provides compelling evidence that opioid misuse contributes to financial instability in the commercial real estate sector. By establishing a clear link between opioid distribution and mortgage delinquency rates, the research reveals how public health crises can trigger broader economic disruptions.

The demonstrated effectiveness of opioid-limiting laws suggests that regulatory interventions could help stabilize financial markets. CRE investors and lenders should incorporate opioid-related risks into their assessment models. The findings indicate that addressing the opioid crisis’s economic impact requires a comprehensive strategy that combines public health policies with targeted financial measures.