HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Alexandre Garel | Arthur Romec | Zacharias Sautner | Alexander F. Wagner

Firm-Level Nature Dependence

May 20, 2025

Key Takeaways

- The study introduces firm-level measures of “nature dependence,” capturing a company’s reliance on ecosystem services such as water regulation, soil formation, or pollination.

- Greater nature dependence is associated with greater downside financial risk, especially for firms with many important dependencies on ecosystem services (vs. an average dependence score).

- Nature dependence correlates strongly with biodiversity impact but not with physical climate risk, highlighting the need to distinguish between climate- and nature-related risks.

- Asset managers such as BlackRock are increasingly engaging firms with high nature dependence, signaling a shift in investor attention toward biodiversity and natural capital.

- Despite growing interest, corporate disclosures on nature dependence remain sparse, revealing a critical gap in environmental transparency and risk management.

Source Publication:

Garel, Alexandre, Romec, Arthur, Sautner, Zacharias, & Wagner, Alexander F. (2025). Firm-Level Nature Dependence. SSRN Working Paper.

Nature Dependence as an Overlooked Financial Risk

Nature is an invisible input in nearly every business model. From clean water and fertile soil to storm protection and pollination, firms rely on ecosystem services. Yet, as biodiversity loss and ecological degradation accelerate, these services may no longer be stable or free. While climate risk has taken center stage in financial discussions, nature-related risks—those stemming from disruptions in ecosystem services—have been comparatively overlooked.

Garel, Romec, Sautner, and Wagner (2025) bring a novel perspective to this issue. It asks, How financially vulnerable are firms to disruptions in the natural systems they rely on? And how are investors responding to this emerging risk?

To answer these questions, the authors develop new firm-level metrics to quantify “nature dependence” and analyze its implications for financial performance, investor engagement, and corporate disclosure practices.

Data and Methodology

Using the ENCORE database—which maps business activities to ecosystem-service dependencies—the authors construct two firm-level measures of nature dependence for over 26,000 publicly listed firms across 115 countries (2010–2022):

- NatureDepOverall: A revenue-weighted average of ecosystem-service dependency scores

- NatureDepOverall #Dep≥4: A count of services with high or very high dependency (score ≥4 out of 6)

These scores are then linked to indicators of financial downside risk, biodiversity impacts, climate exposure, disclosure levels (e.g., CDP reports), and institutional investor engagement from BlackRock.

Finding 1: High Nature Dependence Increases Downside Financial Risk

The study’s core finding is that firms with higher nature dependence face significantly greater downside risk, especially when their dependence spans many critical ecosystem services. This finding is consistent with such firms being exposed to service disruption and the resulting shocks—ranging from supply-chain interruptions to asset devaluation—that can affect financial performance.

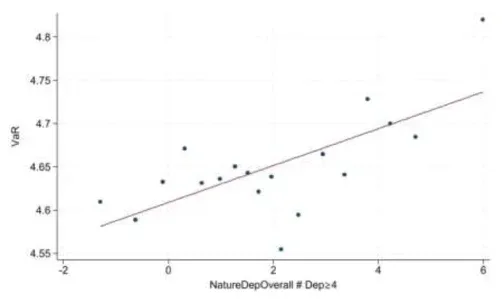

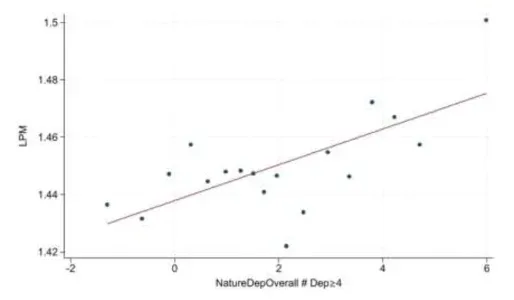

Figure 1 Binned scatter plots for NatureDep scores and downside risk

Panel A NatureDepOverall #Dep≥4 and VaR

Panel B NatureDepOverall #Dep≥4 and LPM

Note: Panel A shows binned scatter plots for the regression-estimated relation between NatureDepOverall #Dep≥4 and VaR, and Panel B shows the relation between NatureDepOverall #Dep≥4 and LPM. The plots are based on 20 bins and after absorbing industry-by-country-by-time fixed effects.

Interestingly, whereas nature dependence is strongly associated with measures of biodiversity footprint, it shows little correlation with measures of physical climate risk. This finding suggests firms may be exposed to environmental risks not captured by standard climate models, underscoring the need to treat nature risk as a distinct category in financial risk assessments.

Moreover, the relationship between nature dependence and financial risk is magnified in highly diversified firms. Although diversification typically reduces exposure to firm-specific shocks, it can also spread ecosystem dependencies across business segments, inadvertently increasing vulnerability to systemic ecological disruptions.

Finding 2: Nature Risk Is Rising on the Investor Agenda

The paper also finds institutional investors are beginning to act on nature-related risks. Firms with high nature dependence are significantly more likely to be targeted by biodiversity-related engagement campaigns (the ones of BlackRock). This trend reflects a growing recognition among asset managers that ecosystem degradation poses not only reputational or regulatory risk but also material financial risk.

Finding 3: Corporate Disclosure on Nature Risk Remains Minimal

Despite its growing salience, nature dependence is still largely absent from corporate environmental disclosures. Even firms with high exposure to ecosystem disruptions often fail to report relevant information through frameworks such as CDP. This lack of transparency hinders both investors and regulators from accurately assessing firm-level environmental risk.

The authors argue this gap calls for enhanced disclosure standards—possibly through mandatory reporting regimes that include nature-dependence metrics alongside climate risk. As the financial sector increasingly embraces “nature-positive” investment strategies, firms that continue to ignore nature-related risks may face higher capital costs or disinvestment.

Policy and Market Implications

This study offers one of the first scalable frameworks for measuring nature dependence at the firm level. Its findings have wide-ranging implications. For regulators, the evidence calls for integrating ecosystem risk into financial oversight and disclosure mandates. For investors, it highlights the importance of factoring in nature-related vulnerabilities when evaluating long-term risk-adjusted returns. And for firms, it signals the need to reassess environmental risk-management practices beyond climate alone.

As biodiversity and ecosystem degradation climb the policy agenda, this paper provides a timely and actionable roadmap for incorporating nature risk into financial analysis. The authors share their firm-level measures of nature dependence in the following public repository: https://osf.io/d85e7/.