HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Davidson Heath|Daniele Macciocchi|Roni Michaely|Matthew C. Ringgenberg

Does Socially Responsible Investing Change Firm Behavior?

11 Sep 2024

Key Takeaways

- The last decade has seen an increasing popularity of socially responsible investing (SRI), with funds claiming their consideration of environmental and social (E&S) issues.

- 81% of the sample SRI funds also claim to engage portfolio firms to impact their E&S practices. However, whether these funds act in accordance with their claims remains unclear.

- This paper examines whether SRI funds select firms based on E&S conduct, and if they do, whether this choice causes improvements in the E&S behavior of their portfolio firms.

- The results indicate SRI funds do select firms with better E&S conduct.

- However, SRI funds do not significantly improve the environmental or social conduct of the firms they invest in, which means no treatment effect arises.

- SRI funds may not be greenwashing, but they could be impacting washing—promoting themselves as making a difference without actually affecting corporate conduct.

Source Publication: Davidson Heath, Daniele Macciocchi, Roni Michaely, Matthew C. Ringgenberg, Does Socially Responsible Investing Change Firm Behavior?, Review of Finance, Volume 27, Issue 6, November 2023, Pages 2057–2083, winner of the Pagano-Zechner Prize for the best (non-investment) paper in the Review of Finance in 2023.

Background and Research Questions.

In recent years, the appeal of socially responsible investing (SRI) has grown significantly among investors who are not only seeking financial returns but might also be motivated by a desire to support positive social and environmental outcomes. SRI funds position themselves as instruments of driving ESG change, claiming to invest in companies with strong ESG practices. Some funds further assert that they actively work to improve the ESG behaviors of firms within their portfolios. However, a key question remains: Do these funds genuinely influence corporate behavior, or are they merely curating portfolios of companies that already demonstrate stronger ESG credentials? Heath et al. (2023) offer an in-depth examination of this issue.Data and Method.

The study analyzes U.S. firms over a nearly decade-long period from 2010 to 2019, using micro-level data from various sources, to assess whether SRI funds genuinely drive corporate improvements in their ESG practices.

Specifically, for environmental metrics, the authors use data from the Environmental Protection Agency (EPA), including measurements of carbon emissions, toxic releases, and investments in pollution abatement initiatives. To assess social performance, the study incorporates employee satisfaction data from Glassdoor, Inc., workplace safety data from the Occupational Safety and Health Administration, and board diversity metrics from BoardEx and Institutional Shareholder Services. The dataset allows for a detailed examination of a wide range of environmental and social indicators, including 18 variables of interest used in the empirical analyses.

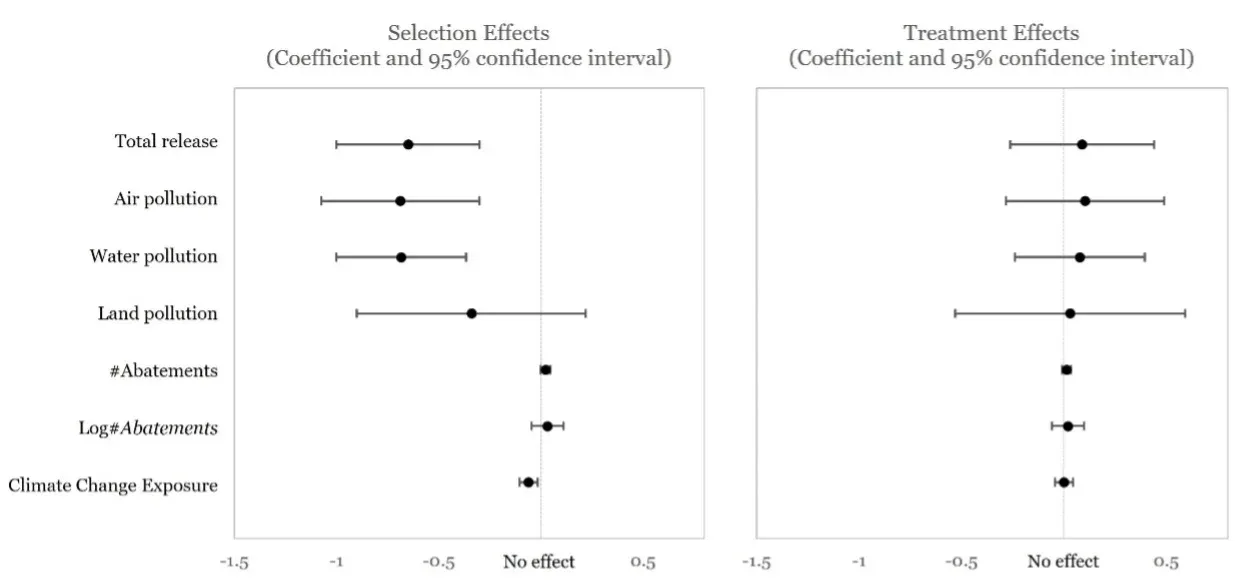

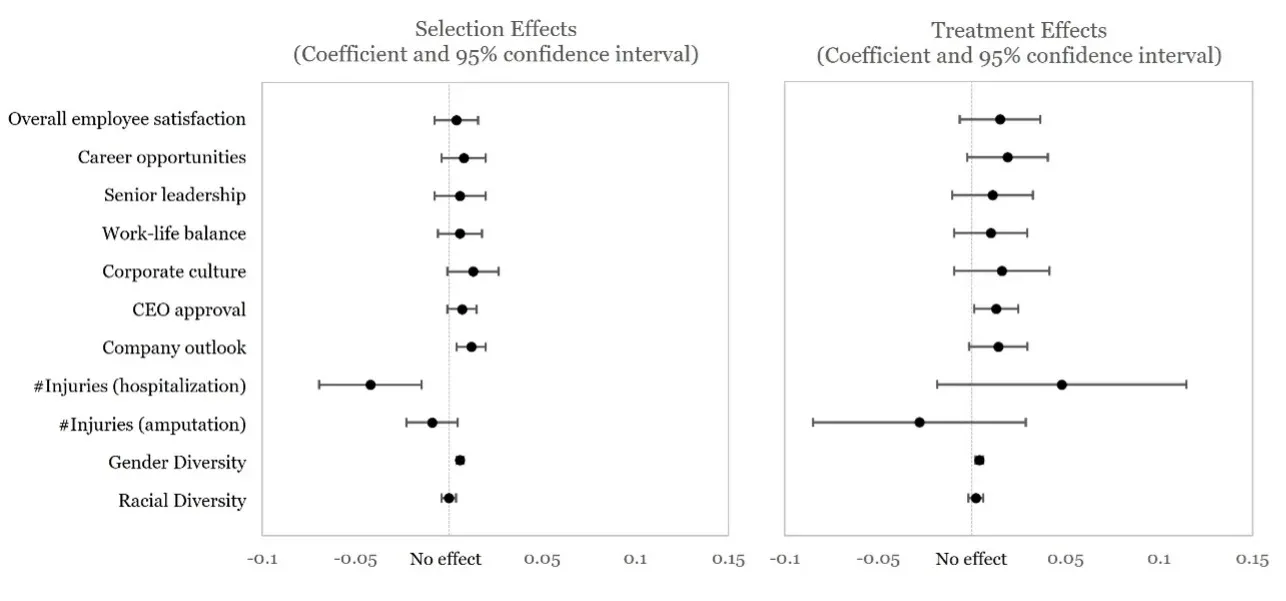

Figure 1. Selection Effects and Treatment Effects of SRI Fund Investment on Corporate E&S Behavior

(a) Effects of SRI funds investment on corporate environmental behavior

(b) Effects of SRI fund investment on corporate employee well-being and board diversity

Results.

Empirical evidence shows SRI funds are effective at selecting companies with stronger existing E&S practices. Specifically, as displayed in the left panels of Figure 1, firms in SRI portfolios have lower pollution levels, more diverse boards, and higher employee satisfaction rates.

To disentangle potential selection effects from the impact of SRI funds on firm behavior, Heath et al. (2023) develop a new research design that exploits the discontinuities in Morningstar “star ratings” as an exogenous shock to SRI fund capital. The results imply that, as shown in the right panels of Figure 1, the involvement of SRI fund capital does not help improve corporate E&S behaviors. In other words, although SRI funds hold firms that pollute less, the study finds no evidence that SRI funds improve the E&S behaviors of the firms they invest in.

Such a result highlights a critical issue in active debate: despite 81% of the sampled SRI funds claiming they actively engage in the ESG practices of their portfolio companies, the empirical evidence reveals increased capital flow in SRI funds does not correlate with improvements in corporate behavior. Important questions remain: Do SRI funds engage with firms to promote E&S practices? If so, why do no positive changes occur?

To further examine whether SRI funds may attempt to take pro-active steps to change firms’ ESG behavior, the research examines whether SRI funds use shareholder proposals or voting strategies to engage in and influence corporate behavior. Results show SRI funds are not acting to improve firm behavior using shareholder proposals. Nonetheless, the authors find SRI funds are more likely to support shareholder proposals addressing ESG concerns than non-SRI funds, though the effect is limited.

Implications.

Although SRI funds have proven successful in identifying and investing in companies with better ESG practices, their influence on enhancing sustainable corporate behavior is unclear. As Alex Edmans (2024), Professor of Finance at London Business School, stated in his post[1] summarizing this paper, SRI funds “simply perform a static assessment” to select companies with good E&S performance.

This study provides important implications for both investors and regulators. For investors who are drawn to SRI funds under the belief that their money will help foster positive social and environmental outcomes, this study calls for a reassessment of those assumptions, and it questions the overall effectiveness of SRI funds in promoting socially responsible corporate practices and whether they truly fulfill their advertised roles.

For regulators and policymakers, the concept of “impact washing” underscores the need for greater scrutiny and transparency in the marketing and operation of SRI funds. Establishing clearer standards and expectations regarding how these funds promote themselves—and then engage with their portfolio companies and measure their impact on corporate behavior—may be necessary.

For example, if the fund prospectus suggests the firm engage with and change its portfolio firms’ ESG behavior, regulators might want to hold it to these promises. Without such frameworks, the potential of SRI funds to drive meaningful change could remain limited, leaving a disconnect between their marketing narratives and their actual influence.

As the demand for socially responsible investing continues to grow, addressing the current shortcomings becomes increasingly important for the industry. The future effectiveness of SRI funds will depend on their ability not just to select responsible companies but to also actively contribute to the improvement of ESG practices within those companies. Without such developments, the role of SRI funds in driving real change will remain limited, and the gap between their promises and their actual impact will persist.

Reference.

Alex Edmans. (2024, Aug). “Does Socially Responsible Investing Change Firm Behavior?” has won the 2024 Pagano and Zechner Prize for the best non-investment paper [Post]. LinkedIn. https://www.linkedin.com/posts/aedmans_does-socially-responsible-investing-change-activity-7234192868804902913-d989