HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

François Derrien | Alexandre Garel | Arthur Romec | Feng Zhou

Climate Risk Engagements: Evidence from a Large Investor

Jun 18, 2025

Key Takeaways

- Research Question: The study investigates the motivations for and effectiveness of climate risk engagements by a large institutional investor, BlackRock.

- Data and Method: Leveraging nearly 6,000 documented climate risk engagements by BlackRock, the study uses standard regressions and a difference-in-differences approach centered on 2020 engagements to evaluate the above questions.

- Findings: Firms with higher carbon emissions and greater exposure to climate transition risk are more likely to be targeted by climate risk engagements.

- Following engagement, targeted firms are more likely to commit to science-based climate targets and disclose climate-related information.

- Targeted firms exhibit a reduction in Scope 1 and 2 carbon emissions, though the magnitude of this reduction is insufficient to align with net-zero goals by 2030.

- The investor is more likely to vote in favor of management proposals, such as director elections, in firms they engage on climate risk issues, suggesting a preference for cooperation over confrontation.

- Implications: Shareholder engagement on climate issues can be an important tool to induce firms to improve their climate policies and reduce certain emissions, but achieving ambitious targets such as net zero may require broader action.

Source Publication: Derrien, François and Garel, Alexandre and Romec, Arthur and Zhou, Feng, 2024, “Climate Risk Engagements,” available at SSRN: https://ssrn.com/abstract=5051906 or http://dx.doi.org/10.2139/ssrn.5051906.

Background and Research Questions

Institutional investors increasingly perceive climate risks as material and believe they can play a crucial role in addressing climate change. Shareholder engagement—discussions with the firm’s executives or directors to influence corporate policies—is a key mechanism through which institutional investors can exert pressure on firms. Despite the promises of shareholder engagement on climate issues, empirical evidence on their effectiveness remains scarce. This paper contributes to an understanding of the motivations and effectiveness of climate engagements by examining the climate risk engagement activities of one of the world’s largest investors, BlackRock.

Data and Methodology

The study utilizes data on BlackRock’s climate risk engagements obtained from the company’s stewardship reports for the period 2020–2023, encompassing 5,964 documented climate risk engagements with targeted firms across global markets. The analysis incorporates firm-level data on carbon emissions from Trucost, regulatory climate change exposure measures from Sautner et al. (2023), climate-change incidents from RepRisk, climate disclosure data from the Carbon Disclosure Project (CDP), and climate target commitments from SBTi (Science Based Target initiative). Data on BlackRock’s ownership and voting behavior are also included. To assess the effects of engagements on firms’ commitment to adopt a climate target, disclosure of climate risks, and carbon emissions, the researchers use a difference-in-differences design focusing on engagements in 2020 and comparing targeted firms with control firms over the two-year window before and after the engagement. Robustness checks include using matched samples, examining dynamic treatment effects, and focusing on firms within BlackRock’s “climate focus universe.” Additional relationships, including determinants of climate risk engagements and the relationship between engagement and voting/divestment, are explored using standard regression analyses.

Findings and Discussion

The study presents several key findings. First, it documents climate risk engagements constituted around 30% of BlackRock’s ESG engagements over the study period. These engagements were more frequent in high-carbon-emission industries such as Utilities and Petroleum and Natural Gas because they have greater exposure to climate transition risks. At the firm level, firms with higher Scope 1 and 2 carbon emission levels were significantly more likely to be targeted, whereas emission intensity did not show this strong association. Firms with greater exposure to regulatory climate change risk and more climate-related incidents were also more likely to be engaged. Importantly, none of these different variables predict the likelihood of BlackRock’s engagements on social or governance issues.

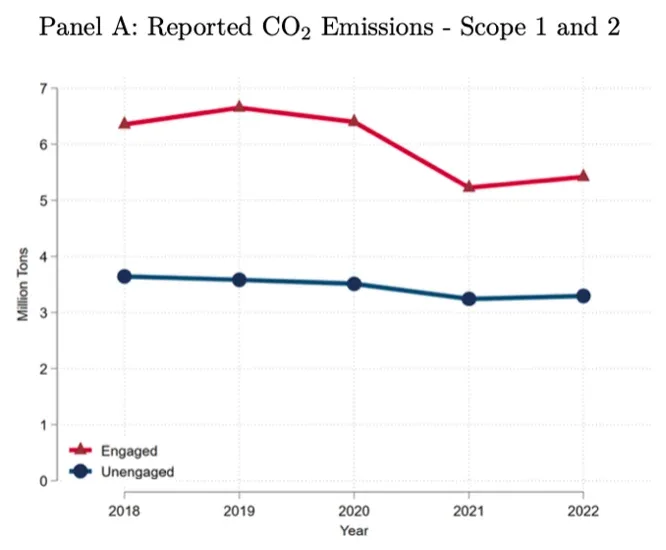

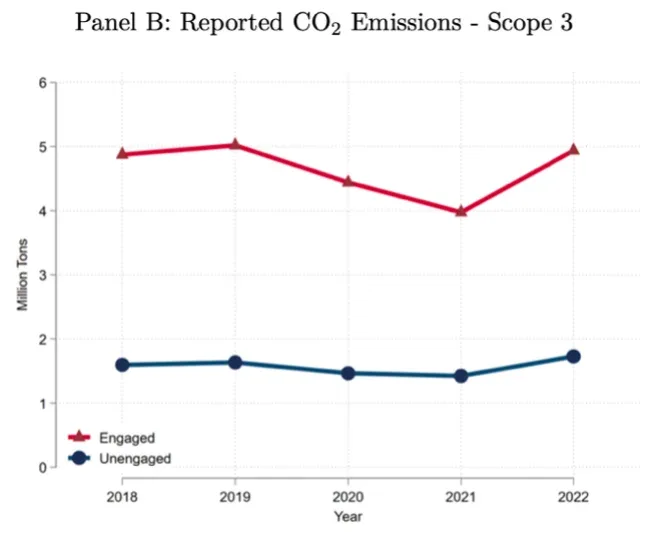

Second, the research demonstrates BlackRock’s climate risk engagements have observable effects on targeted firms’ climate policies. Targeted firms were significantly more likely to commit to setting science-based climate targets with SBTi. For firms that were not answering the CDP questionnaire, engagement led to a significantly higher likelihood of starting to respond to the questionnaire. The study also finds a significant reduction in Scope 1 and 2 carbon emissions for targeted firms, amounting to a relative decrease of 7.5% per year in the two years post-engagement. However, the study finds no significant reduction in Scope 3 emissions, consistent with the investor’s stated policy regarding the complexity and control issues associated with Scope 3 emissions. The observed reduction in Scope 1 and 2 emissions is considered modest and insufficient to align firms with a net-zero path consistent with the 1.5°C target by 2030.

Figure 1: Evolution of Carbon Emissions for Firms Targeted by Climate Risk Engagement and Control Firms

Note: This figure reports the time-series evolution of the average level of Scope 1 and 2 emissions (Panel A) and Scope 3 emissions (Panel B) for the firms targeted by climate risk engagement in 2020 and control firms before and after the engagement. The sample is restricted to firms that report their carbon emissions (i.e., we exclude firms for which carbon emissions are estimated by Trucost).

Third, the paper explores the relationship between climate engagements and BlackRock’s voting and divesting behavior. It finds BlackRock is significantly more likely to vote in favor of management proposals related to director elections in firms targeted by climate risk engagements. This observation suggests BlackRock seeks to foster cooperation and communication rather than confrontation with management to achieve material change on firms’ climate policies. Conversely, BlackRock is significantly less likely to support climate-related shareholder proposals in these engaged firms, consistent with BlackRock viewing these proposals as too prescriptive and constraining and potentially conflicting with the objectives of its engagements. The study finds no evidence that climate engagements influence BlackRock’s divestment decisions, consistent with its largely passive, index-tracking investment strategy.

Implications

The findings suggest shareholder engagement on climate risk is a tool that can induce targeted firms to adopt climate-related policies such as setting science-based targets and increasing climate disclosure. It also contributes to a measurable reduction in firms’ Scope 1 and 2 carbon emissions. However, the modest magnitude of emissions reduction relative to net-zero targets highlights the limitations of this type of engagement, at least as currently practiced by a large, diversified investor such as BlackRock. The focus on Scope 1 and 2 emissions suggests investors and regulators may need to address Scope 3 emissions more directly for comprehensive decarbonization. The investor’s voting behavior suggests a strategy of preferring cooperation to confrontation via shareholder proposals in firms they engage. This finding implies that although engagement can be effective, its approach and scale may need to evolve to drive more ambitious emissions reductions required for global climate goals. For firms, having a large carbon footprint and exposure to climate transition risk increases the likelihood of being targeted for engagement.