HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Alexandre Garel | Roni Michaely | Arthur Romec

Climate Disclosure and Director Elections

Mar 11. 2025

Key Takeaways

- This study examines how climate-related disclosures impact investor support for directors during board elections.

- Firms that fail to disclose carbon emissions experience significantly lower support for their directors.

- Companies that begin disclosing climate-related information see a notable increase in director support.

- Sustainable funds and universal investors are key drivers of the trend to vote against directors in firms lacking carbon disclosure.

- Investors who support shareholder-sponsored climate proposals are more likely to vote against directors in firms without carbon disclosure.

- Voting against directors has become an effective way for investors to influence boards’ approach to climate change and disclosure.

Source Publication: Garel, A., Michaely, R., & Romec, A. (2025). Climate Disclosure and Director Elections. SSRN Working Paper.

Background and Research Question.

Institutional investors are increasingly concerned about climate risks. Evidence suggests that investors are using votes against directors to signal discontent with companies’ climate-related policies and disclosures. For example, BlackRock has stated that it may withhold support for the re-election of directors in firms with inadequate climate disclosures.

This study explores whether voting against directors in firms with insufficient climate disclosure serves as a channel for expressing such concerns. The key research question addressed is: Does the quality of climate disclosure influence investor support for directors during board elections?

Data and Methodology

The study uses a sample of over 1,800 U.S. public companies from 2017 to 2022. Carbon emission data was sourced from Trucost, which tracks carbon disclosures and estimates emissions where data is unavailable. Other disclosure measures include data from the Carbon Disclosure Project (CDP), which provides a comprehensive assessment of firms’ climate transparency. The study also includes voting records from mutual funds, sourced from Risk Metrics’ ISS Voting Analytics, as well as governance data, accounting data, and ESG incident data from various industry-standard platforms.

Findings and Discussion

The study reveals that firms that do not disclose carbon emissions tend to experience significantly lower support for their directors in board elections. This finding remains robust after accounting for various control variables. Moreover, firms that began disclosing their carbon emissions saw a noticeable increase in director support, suggesting that transparency on climate matters is valued by investors.

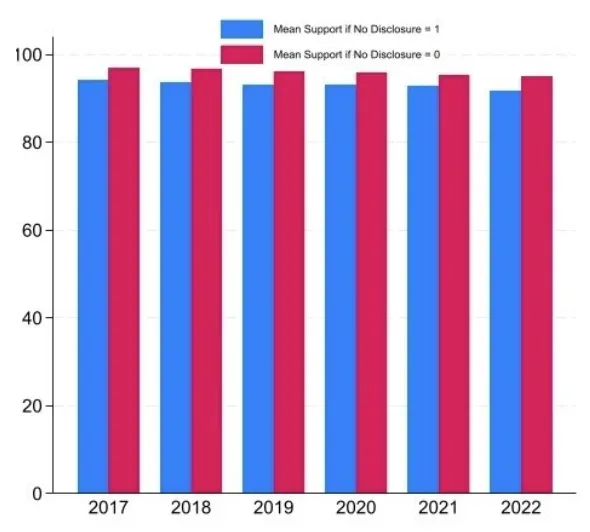

Figure 1. Director support over time conditional on carbon disclosure

Note: This figure reports the yearly average support to directors in board elections (%) for firms that do not disclose their carbon emissions (i.e., firms with a carbon disclosure flag set to “estimated data” by Trucost) (No Disclosure = 1) and firms that (at least partially) publicly disclose their carbon emissions (No Disclosure = 0) over 2017-2022.

The research further finds that sustainable funds and universal investors are more likely to vote against directors in firms that lack carbon disclosure. This highlights a growing trend where investors with a strong commitment to climate action are holding companies accountable for insufficient transparency. Additionally, investors who support shareholder-sponsored climate proposals tend to use their votes to challenge directors in firms with poor climate disclosure.

Policy or Market Implications

These findings underscore the growing significance of climate disclosure in corporate governance. Investors are increasingly leveraging their voting rights to demand greater climate transparency and accountability from boards. As institutional investors, especially in the US, are more and more reluctant to support prescriptive shareholder proposals, we can expect more funds to choose voting against directors to express their concerns on climate disclosure.