HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Shipeng Yan|Juan (John) Almandoz|Fabrizio Ferraro

The impact of logic (in)compatibility: Green investing, state policy, and corporate environmental performance

Oct 19, 2024

Key Takeaways

- Green investing, or investing with an explicit environmental mission, has risen globally as a market-based approach to tackling pressing environmental challenges.

- Whether green investment funds effectively enhance corporate environmental performance, and how they interact with state policies—traditionally the primary mechanism for environmental action—remains underexplored.

- This study finds green investment funds do indeed improve corporate environmental performance.

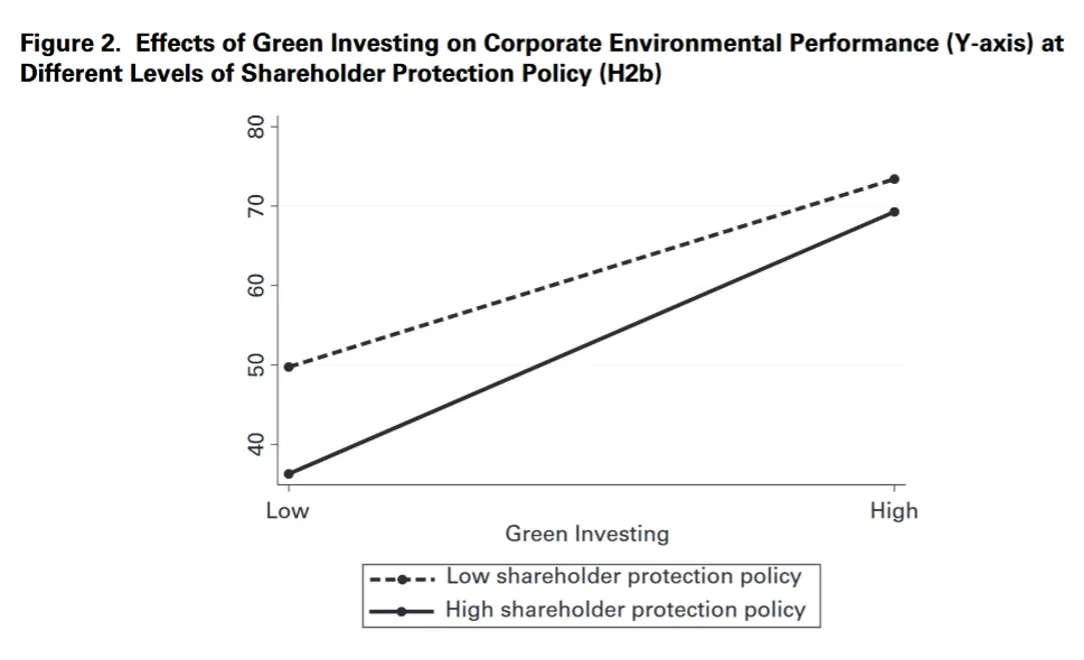

- Interestingly, strong shareholder protection policies—often seen as prioritizing profit over environmental concerns—actually amplify the impact of green investment funds by empowering them to push for change.

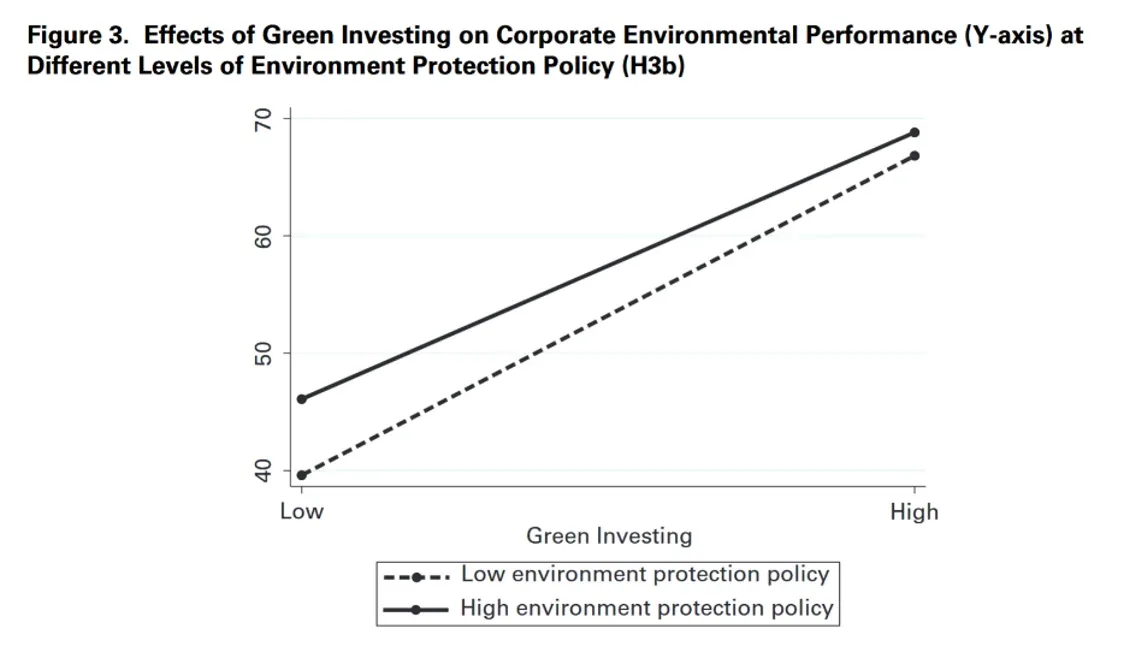

- By contrast, more stringent environmental policies diminish the influence of green investment funds by shifting companies’ focus to regulatory compliance.

- Effective solutions to critical environmental challenges should consider the complex and sometimes counterintuitive interplay between state and market approaches.

Source Publication: Shipeng Yan, Juan (John) Almandoz, Fabrizio Ferraro. 2021. The impact of logic (in)compatibility: Green investing, state policy, and corporate environmental performance. Administrative Science Quarterly, 66(4): 903-944, winner of the IESE Alumni Research Prize for Best Published Paper in 2022. This paper is also featured in UNPRI blog, IESE Insight, ASQ student blog, Guancha.cn

Background and Research Questions.

Environmental protection is traditionally seen as a state responsibility, and the private market is meant to focus on creating shareholder value rather than preserving nature. Still, market-based solutions such as green investing have emerged. The research addresses whether green investment funds can influence firm-level environmental performance in relation to the presence of state environmental- and shareholder protection policies.

Method.

We study whether the prevalence of green investing, defined as the proportion of green funds in a country by number and assets, influences corporate environmental performance, and how state policies might enhance or diminish this effect.

Theoretically, we use an institutional logics perspective to explore the potential complementarity between green investing and state policies. Institutional logics are societal cultural forces that shape values, norms, and practices. For instance, financial logic promotes self-interest and profit maximization, environmental logic focuses on planet preservation, and state logic emphasizes nation-building and collective interest. Real-world practices typically combine these different logics. Therefore, green investing can be seen as a blend of financial and environmental logics, with financial logic acting as a means to achieve environmental goals. Similarly, we view state environmental and shareholder protection policies as examples of state logic supporting the goals of environmental preservation (environmental logic) and profit maximization (financial logic), respectively.

Empirically, we employ a number of tests to confirm our results. In addition to ordinary least squares models with firm-level fixed effects, we also use Kyoto Protocol Ratification and the BP oil crisis as quasi-experimental opportunities for difference-in-differences analyses, with consistent results.

Results.

We find the proportion of green investment funds in a country’s financial sector had a positive relationship with firms’ environmental performance there. A one-standard-deviation increase in our measure of green investing is associated with an increase of 6.17 in the corporate environmental score (full score = 100). For example, South Korea in 2007 can be characterized as an average country in terms of green investing. It had 4,736 funds, 16 of which (0.34%) were green funds. With a one-unit increase in the proportion of green investing (from 0.34% to 0.91%, from 16 to 43 funds), South Korea would have moved up four places, from ninth to fifth, in the 2007 ranking of average corporate environmental performance among all countries in our sample.

Strong shareholder protection policies often negatively impact corporate environmental performance, because these laws prioritize shareholder value over environmental concerns. We found firms in countries with stronger shareholder protection laws had weaker environmental performance. However, when combined with green investing, these policies actually strengthened the positive impact of green investing on environmental performance.

Conversely, strong state involvement in environmental protection generally improves companies’ environmental performance through taxes and mandatory standards. Our findings confirmed a positive relationship between robust environmental protection laws and better corporate environmental performance. However, strong environmental policies can reduce the influence of green investing, because companies may view the state as the primary enforcer of environmental standards and limit themselves to legal compliance.

Implications.

As climate concerns mount, identifying effective governance solutions to environmental protection is becoming more essential. Our study finds both the state and the private sectors are critically important. Our results on the moderation effect of environmental and shareholder policy suggest the effect of state intervention is nuanced. They suggest the state, in addition to playing a dominant role in environmental protection, could contribute through a peripheral route. For instance, it can provide material support to hybrid practices, such as green investing, that are closer to the problem.