HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Lei Li | Liwei Weng | Lixin (Nancy) Su | Cheng (Colin) Zeng

Documenting the Undocumented: The Impact of Employment Verification Mandates on Government Borrowing Costs

Sep 22, 2025

Key Takeaways

- Research Question: This study examines how state-level employment verification mandates (E-Verify), targeting undocumented workers, influence municipal bond markets and government borrowing costs.

- Method and Data: The authors apply a stacked difference-in-differences design to analyze over 1 million municipal bond issuances from 2000 to 2020, leveraging the staggered rollout of E-Verify mandates across U.S. states to isolate their impact on government borrowing costs.

- Main Findings: Adoption of E-Verify laws leads to a statistically significant reduction in municipal bond spreads by 5.6 basis points, translating into substantial annual fiscal savings for states.

- The effect is more pronounced in states with larger undocumented populations, stronger enforcement, and more negative public sentiment, but diminishes in economies reliant on undocumented labor.

- E-Verify mandates reduce both tax revenues and government expenditures, which collectively improve fiscal balances and market perceptions of state creditworthiness.

- Implication: These findings offer new insights into how immigration policies affect public finance, and provide empirical guidance for policymakers navigating the complex terrain of undocumented immigration.

Source Publication: Li, L., Weng, L., Su, L.N., & Zeng, C.C. (2025). Documenting the Undocumented: The Impact of Employment Verification Mandates on Government Borrowing Costs. SSRN Working Paper.

Background and Research Questions

Undocumented immigration remains a complex and highly debated issue in public finance, with conflicting arguments regarding its fiscal costs and economic contributions. Although undocumented workers are integral to certain labor markets, concerns persist about their impact on public services and government budgets. This study explores a novel dimension by examining how municipal bond markets—key indicators of government fiscal health—respond to immigration enforcement policies. Specifically, it investigates whether and how state-level mandates requiring employment verification through E-Verify influence government borrowing costs. The research also probes which fiscal channels and state-level conditions mediate these effects, aiming to shed light on the broader financial consequences of immigration policies.

Data and Methodology

The analysis draws on an extensive dataset comprising over 1 million municipal bond offerings issued by U.S. state and local governments from 2000 to 2020. Bond data, including spreads and detailed issuance characteristics, were sourced from the FTSE Russell Municipal Bond Securities Database. State-level information on the timing and nature of E-Verify mandates was obtained from the National Conference of State Legislatures, whereas demographic, fiscal, and undocumented immigrant population estimates were compiled from U.S. government agencies and research estimates.

The core empirical strategy is a stacked difference-in-differences design exploiting the staggered adoption of E-Verify mandates across states. This approach compares changes in bond spreads before and after mandate implementation in adopting states relative to non-adopting states, while controlling for bond and state characteristics. Extensive robustness checks, including propensity score matching and exclusion of states undergoing concurrent policy shifts, confirm the validity of causal inference. The study further examines heterogeneity by interacting treatment effects with state-level measures of undocumented population size, enforcement rigor, economic dependence on undocumented labor, and public attitudes.

Findings and Discussion

The study finds states implementing E-Verify mandates experience a statistically and economically significant decline in municipal bond spreads, averaging a reduction of 5.6 basis points relative to control states. This reduction in borrowing costs translates into estimated annual savings of approximately $4.68 million per state, underscoring the fiscal importance of immigration enforcement policies.

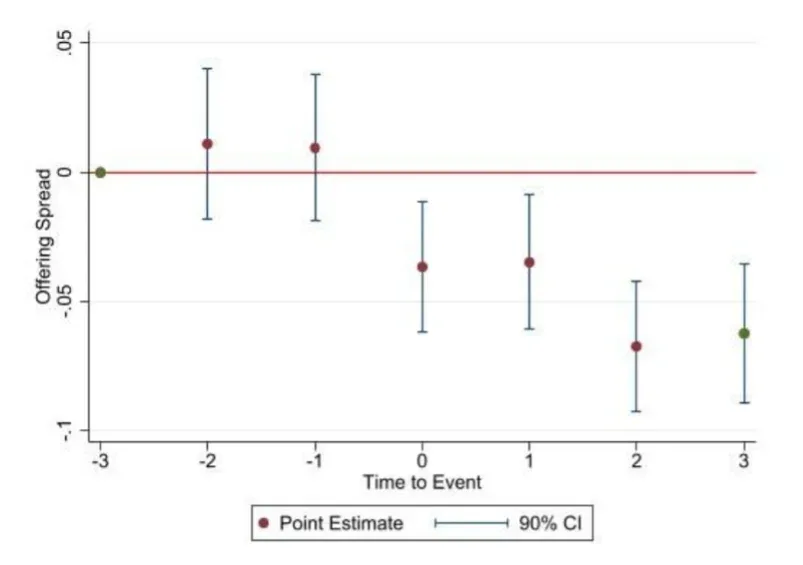

Figure 1. Dynamics of Coefficient Estimates

Note: This figure plots the dynamic coefficient estimates of the effect of E-Verify on government offering spreads with corresponding 90% confidence intervals. On the X-axis, 0 represents the treatment year, −3, −2, and −1 represent three years, two years, and one year before the treatment year, respectively, and 1, 2, and 3 represent one year, two years, and three years after the treatment year, respectively. We use three years before the treatment year (i.e., X = −3) as the benchmark.

Delving into mechanisms, the research reveals that although E-Verify adoption corresponds with a decline in tax revenues attributable to undocumented immigrants—spanning property, sales, and individual income taxes—this revenue loss is offset by proportionate reductions in government expenditures, particularly in education and social welfare. These fiscal adjustments culminate in a meaningful contraction of local government deficits, which likely drives improved credit perceptions among bond investors.

Importantly, the study finds E-Verify mandates successfully reduce the estimated undocumented immigrant populations in states where they are enacted, thereby achieving their intended labor market impact. This demographic shift reinforces the fiscal improvements observed.

The magnitude of borrowing-cost reductions is not uniform but shaped by contextual factors. States with larger undocumented populations see a more pronounced effect, as enforcement reshapes their labor and fiscal landscapes more substantially. States with stronger enforcement capacity—proxied by lower corruption—experience amplified benefits, highlighting the role of credible policy execution. By contrast, states economically reliant on undocumented labor show muted effects, reflecting investors’ nuanced consideration of potential trade-offs between enforcement benefits and economic disruptions. Additionally, states characterized by more negative public sentiment toward undocumented immigrants, as measured through Google search indices, also register greater reductions in borrowing costs, suggesting socio-political climate influences market perceptions.

Both public-sector and universal E-Verify mandates reduce borrowing costs, with universal mandates exerting somewhat stronger impacts, reflecting the broader scope of labor market coverage.

Policy and Market Implications

For policymakers, these insights underscore the potential fiscal benefits of employment verification programs, informing debates over immigration reform and enforcement. From the perspective of municipal bond investors, the research highlights how enforcement policies alter risk assessments and capital costs for state and local governments. Ultimately, the study offers a data-driven perspective on the fiscal and financial trade-offs inherent in addressing undocumented immigration, enriching policy discussions with rigorous empirical evidence.