HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Johannes Klausmann | Philipp Krueger | Pedro Matos

The Green Transition: Evidence from Corporate Green Revenues

Jun 10, 2025

Key Takeaways

- Research Question: This study introduces a new metric for measuring corporate revenues from green products and services among global publicly listed firms, and investigates the extent, drivers, and consequences of firms’ transition toward generating “green revenues.”

- Data and Method: Leveraging firm-level green revenue data from FTSE Russell GRCS, the study employs a cross-sectional difference-in-differences design centered on the Paris Agreement, along with additional fixed-effects regressions and portfolio return analyses, to examine the above questions.

- Findings: Global green revenues grew rapidly after the 2015 Paris Agreement, driven by innovative US companies converting green patents into commercial revenues and by firms with higher sustainability-focused institutional ownership before the Paris Agreement.

- Stock market analysis shows modest evidence that firms generating green revenue experienced positive alpha in the period following the Paris Agreement. The effect is primarily concentrated in US stocks and is stronger among firms with the highest green revenues, pre-existing green patents, or higher institutional ownership.

- The outperformance of green revenue stocks is likely driven by a combination of lower discount rates for green firms and unexpected shifts in climate-related concerns, rather than an underestimation of earnings by firms with higher green revenues.

- Implications: The findings indicate green revenues are a significant economic factor reflecting a firm’s contribution to environmental solutions and commercial benefit from the green economy transition.

Source Publication: Klausmann, Johannes and Krueger, Philipp and Matos, Pedro, 2024, “The Green Transition: Evidence from Corporate Green Revenues”, SSRN Working Paper, Available at SSRN: https://ssrn.com/abstract=4850449 or http://dx.doi.org/10.2139/ssrn.4850449

Background and Research Questions

Rising global challenges related to climate change and environmental degradation pressure companies to adopt green business models. To investigate the extent of this transition, this study introduces a novel measure of corporate revenues from selling environmentally friendly products and services. The research further explores the technological and market drivers behind the extent to which firms offer environmentally beneficial products and services, and it examines the financial consequences of green revenues.

Data and Methodology

The study introduces a novel measure of revenues from green products and services for publicly listed firms worldwide from the FTSE Russell Green Revenues Classification System. The data cover over 16,000 firms in 48 developed and emerging markets between 2008 and 2023. Green revenues are calculated through disclosed information (approximately a quarter) and company-specific estimates and direct engagement with firms (around three-quarters). Missing data from 2008 to 2015 were backfilled using an approach consistent with FTSE Russell reports. The study also incorporates data from the Global Corporate Patent Dataset, institutional ownership data including information on PRI and CDP signatories, country-level Environmental Performance Index, and Integrated Values Survey data.

The research employs empirical methods, including analyzing aggregate trends over time, and uses the unexpected passage of the Paris Agreement in 2015 as a regime shift to the global commitment to address environmental challenges. A cross-sectional difference-in-differences research design is used, taking predetermined firm characteristics such as pre-Paris green patents and institutional ownership (level and sustainability-orientation) as exposures to the Paris shock. Regression models, including OLS with fixed effects, are employed to estimate the impact of these drivers on green revenues. Stock returns are examined using factor models (e.g., Fama-French, Carhart) on portfolios sorted by green revenues. To enhance the robustness of the study, various additional tests include alternative green revenue definitions (Tier 1, EUTSF-eligible), placebo tests, and excluding outlier firms such as Tesla.

Findings and Discussion

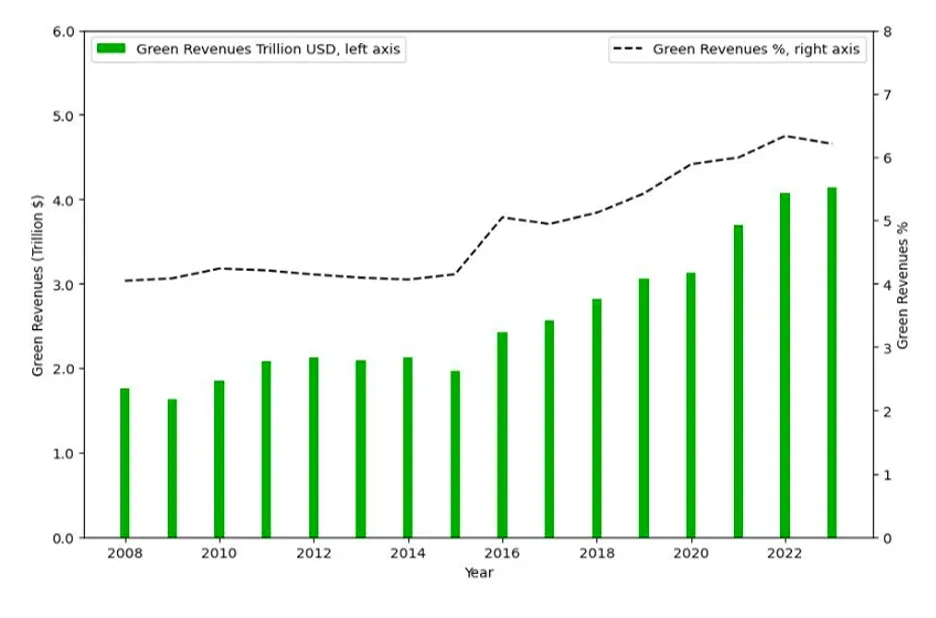

The study finds the green transition has accelerated significantly since the Paris Agreement, with aggregate global green revenues exceeding 4 trillion USD and 6% of total revenues by 2023. Whereas the US, China, and Japan have the largest absolute dollar green revenues, European firms show higher green revenue exposure relative to total revenues.

Figure 1. The Growth of Corporate Green Revenues

Note: The left axis shows total annual revenues derived from green products and services for publicly listed companies worldwide (in USD trillions). The right axis shows the percentage of green revenues relative to total company revenues.

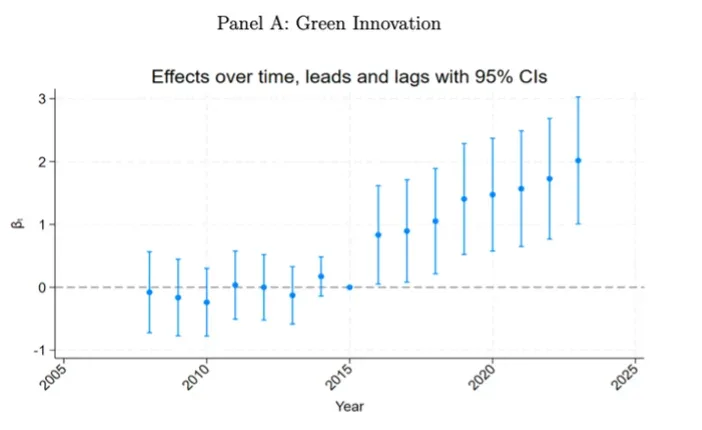

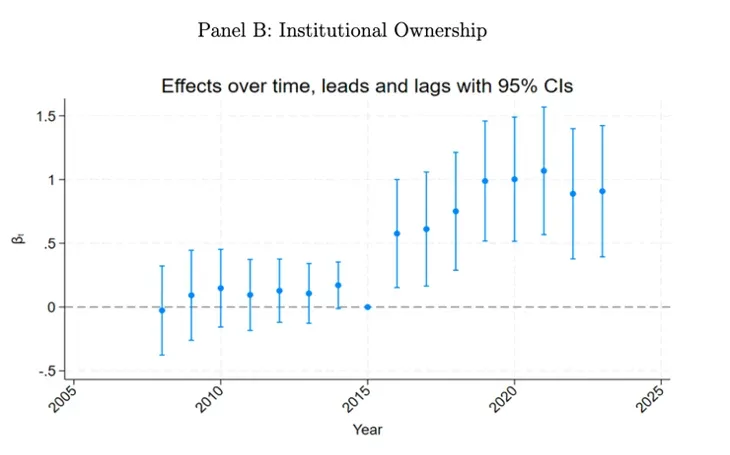

Two key drivers facilitate a firm’s generation of green revenues: internal innovative capabilities and external support from its shareholder base. Firms with at least one green patent before the Paris Agreement experienced, on average, a 2.3-percentage-point increase in green revenue shares after the Paris Agreement came into effect, compared with firms without green patents pre-Paris. This relation is specific to green patents, not general innovativeness. The conversion of green patents into revenues was stronger for US companies, where regulatory pressure post-Paris was less pronounced than for European companies. Moreover, a one-standard-deviation increase in pre-Paris institutional ownership is associated with a roughly 0.3-percentage-point increase in green revenue post-Paris. Firms owned by institutional investors signed to principles such as PRI and CDP members, or by long-term institutions pre-Paris, are associated with a stronger acceleration in green revenues post-Paris.

Figure 2. Difference-in-differences Tests on the Drivers of Green Revenues

Note: The plots illustrate the annual regression coefficients for a balanced panel dataset, covering the years 2008–2023, both before and after the Paris Agreement. Blue dots represent the coefficient estimates, whereas the lines indicate 95% confidence intervals. The graph in Panel A displays the yearly regression coefficient estimates for an indicator variable equal to 1 if a firm held at least one green patent before the Paris Agreement, and 0 otherwise. The graph in Panel B presents a dynamic coefficient plot for an indicator variable equal to 1 if the firm’s institutional ownership share is above the sample median, and 0 otherwise.

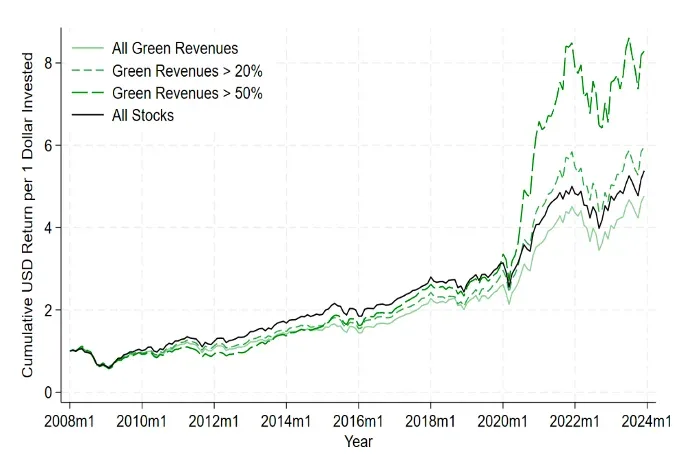

The authors also investigate the financial consequences of shifting to greener business models. The study finds modest evidence of a positive alpha from investing in green revenue stocks mostly concentrated in the post-Paris period. This positive green alpha is driven primarily by US stocks. It is also strongest among firms well positioned for the transition, specifically those with green patents and higher institutional ownership pre-Paris. The observed outperformance is likely explained by a combination of lower implied cost of capital (discount-rate effect) for green firms and inflows into stocks with high green revenues after unexpected shocks to environmental concerns, rather than an underestimation of revenues by firms with higher green revenues.

Figure 3. Green Revenues Portfolios Returns

Note: The figure plots cumulative returns per 1 USD invested for the value-weighted green stocks portfolio (light green), which we contrast with portfolios containing stocks with at least 20% (dashed green) and 50% (dashed darker green) green revenues, respectively. The black line plots cumulative returns for the portfolio including all stocks in our sample and serves as a benchmark.

Policy or Market Implications

The findings demonstrate green revenues are an important economic metric capturing a firm’s tangible contribution to environmental solutions and its commercial success in the green economy. This measure is different from operational sustainability measures that are usually considered in the climate finance literature. The acceleration of green revenues post-Paris suggest major global commitments can spur corporate transition, potentially facilitated by frameworks such as the EU Taxonomy.

The emergence of a “green alpha,” particularly in the US post-Paris, suggests markets have started to price in the value associated with green business activities. Considering green revenues can provide market participants with new insights into firm performance and value beyond traditional ESG scores. Policymakers may find the evidence on the impact of regulatory shifts (e.g., the EU Taxonomy rollout) relevant for designing effective environmental policies to steer private capital toward green activities.