HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Thilo Erbertseder | Martin Jacob | Constance Kehne | Hannes Taubenböck

Dirty Taxes: Corporate Taxes and Air Pollution

Apr 22, 2025

Key Takeaways

- The study investigates how corporate taxes influence air pollution, focusing on nitrogen dioxide (NO2) emissions.

- A 1% increase in local business taxes in Germany correlates with a 0.15% rise in local NO2 levels.

- Higher corporate taxes may deter firms from investing in cleaner technologies, because higher taxes reduce available capital necessary for costlier investments in cleaner assets.

- The relationship between corporate taxes and pollution is especially pronounced in areas with industries that are more polluting, as well as in less flexible firms and for investments that are more irreversible.

- The findings suggest corporate tax policies could unintentionally worsen environmental outcomes by exacerbating air pollution.

- Policymakers should factor in the environmental impact of corporate taxes when designing tax policies.

Source Publication:

Erbertseder, T., Jacob, M., Kehne, C., & Taubenböck, H. (2024). Dirty Taxes: Corporate Taxes and Air Pollution. SSRN Working Paper

Background and Research Questions

The role of corporate taxes in shaping economic outcomes has been a subject of extensive research. However, the environmental consequences of such taxes, particularly in terms of air pollution, remain underexplored. This study seeks to fill this gap by examining the relationship between corporate taxation and NO2 emissions, a key indicator of air pollution. Given the increasing global focus on environmental taxes aimed at reducing emissions and combating climate change, assessing whether corporate taxes—arguably a more common form of taxation—might inadvertently contribute to environmental degradation is crucial.

This research specifically investigates whether higher corporate taxes correlate with increased air pollution, particularly NO2 levels, which are linked to a range of adverse health and environmental outcomes. By doing so, the study aims to provide insights into the broader implications of corporate tax policies, extending the discussion beyond traditional economic metrics to encompass environmental welfare.

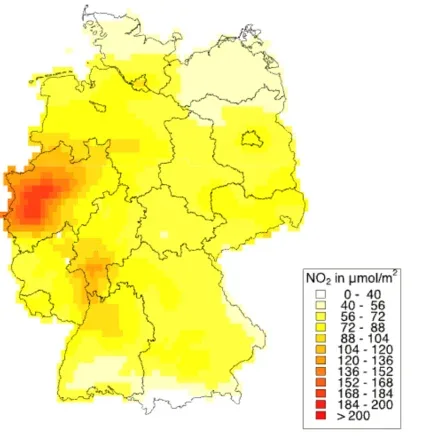

Figure 1: NO2 Air Pollution Data in Germany

Note: This figure shows the distribution of NO2 air pollution in Germany averaged from 2008 to 2020 as derived from daily OMI satellite observations.

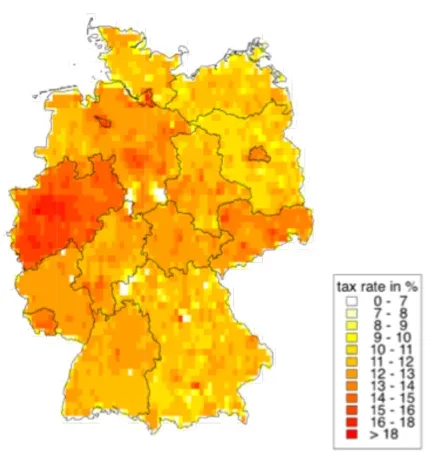

Figure 2: Local Business Tax in Germany

Note: This figure shows the values of the local business tax across Germany aggregated to the cell level (averaged over the period 2008–2020)

Data and Methodology

The analysis draws on a unique dataset combining satellite-derived NO2 measurements with detailed local business tax rates across German municipalities from 2008 to 2020. The satellite data, provided by the Ozone Monitoring Instrument (OMI), offer a spatially comprehensive and homogeneous measure of tropospheric NO2 concentrations, serving as a proxy for local pollution levels (see Figure 1). The local business tax rates, which are set by over 10,000 municipalities across Germany, exhibit significant variation, providing an ideal setting for analyzing the effect of tax changes on air quality (see Figure 2).

To isolate the impact of tax changes on NO2 levels, the authors employ a generalized difference-in-differences design. This approach compares regions experiencing tax rate adjustments with comparable regions without such changes, while controlling for local economic and sociodemographic factors. The firm-level data from the Bureau van Dijk’s Amadeus database add granularity to the analysis by accounting for local economic activity and potential mechanisms.

Findings and Discussion

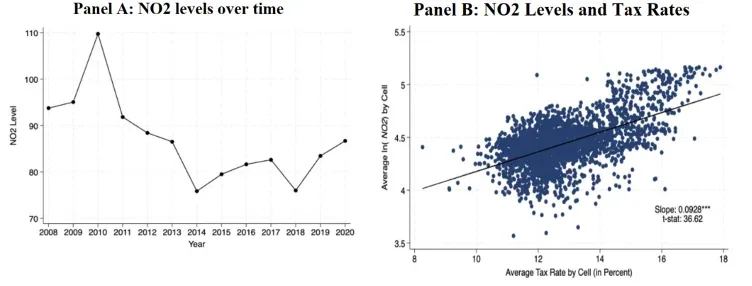

The study uncovers a robust and statistically significant positive correlation between local business tax rates and NO2 levels. Specifically, a 1% increase in local business taxes corresponds to a 0.15% rise in NO2 concentrations, suggesting higher corporate taxes impede the trend toward cleaner air, which would otherwise be expected from technological advancements and economic development (see Figure 3, Panel A). Panel B of Figure 3 illustrates the positive correlation between tax rates and air pollution.

Figure 3: Air Pollution and Tax Rates

Note: Panel A plots the average NO2 levels over time. Panel B plots the average NO2 burden (in natural logarithm) by cell on the y-axis and the average tax rate in a cell on the x-axis (both averaged from 2008 to 2020). The line represents the fitted line from regressing NO2 levels on tax rates.

Further analysis reveals the effect of tax increases on pollution becomes apparent with a one-year lag, supporting the parallel-trends assumption. Additional placebo tests, such as examining weekday versus weekend pollution patterns and regions with predominantly unincorporated businesses, corroborate these findings and address concerns about confounding factors.

The authors delve into the mechanisms behind these results, proposing that higher taxes hinder firms’ ability to invest in cleaner technologies by increasing the cost of capital. Although direct data on investments in cleaner versus dirtier assets are unavailable, firm-level analysis indicates sectors with cleaner technologies are more sensitive to tax-induced reductions in investment than are more polluting sectors. Furthermore, the relationship between taxes and pollution is stronger in regions where firms’ investments are more irreversible, such as those in durable industries with high capital intensity.

Additionally cross-sectional tests also suggest the negative effects of taxes on air quality are more pronounced in areas where firms exhibit lower flexibility to adopt new technologies. Conversely, regions with more adaptable firms, such as start-ups and those with high growth potential, experience a weaker relationship between taxes and pollution.

Policy or Market Implications

This study raises important questions for policymakers regarding the unintended environmental consequences of corporate tax policies. Although corporate taxes are typically seen as essential tools for raising government revenue, this research highlights the potential trade-offs between fiscal objectives and environmental goals. Specifically, it suggests high corporate tax rates may disincentivize investment in cleaner technologies, thus exacerbating air pollution and undermining efforts to reduce carbon emissions.

The findings underscore the need for a more nuanced approach to tax policy, one that takes into account the environmental implications of corporate taxes. As such, policymakers should consider complementing corporate tax policies with incentives for green investments, such as targeted subsidies or tax credits for environmentally friendly technologies, to offset the negative environmental externalities associated with higher taxes.

Additionally, the study calls for a broader rethinking of fiscal policy that incorporates environmental sustainability as a central concern, ensuring tax systems are designed with an eye toward achieving both economic and environmental well-being.