HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Ran Duchin | Joseph Kalmenovitz | Jeffery (Yudong) Wang

Navigating the Revolving Door: Career Paths of Senior Regulators and Their Implications

Apr 22, 2025

Key Takeaways

- This study compiles a comprehensive database of senior federal regulators and traces across the private and public sectors their full career paths since college graduation.

- The prevalence of revolving-door moves across the private and public sectors is high, persistent, and linked to economic and election cycles. Regulators often experience multiple transitions throughout their careers.

- Revolving-door regulators engage in more regulatory activity (though not deregulatory), enforce more strictly, and manage more complex regulations than their non-revolving-door peers.

- These regulators are typically employed by stronger firms, come from relatively less affluent backgrounds, and accumulate significant personal wealth over time.

- The research suggests regulators are motivated by the prospect of future private-sector opportunities, building “bureaucratic capital” through active regulation and enforcement to signal their competence.

- The revolving-door phenomenon has implications for regulatory effectiveness, power dynamics between regulators and firms, and career progression in both the public and private sectors.

Source Publication:

Duchin, Ran, Kalmenovitz, Joseph, and Wang, Jeffery (Yudong). (2024). Between Boardrooms and the Beltway: The Career Paths of Senior Regulators. SSRN Working Paper.

Background and Research Questions

The practice of regulators moving between government agencies and the industries they regulate—referred to as the “revolving-door” phenomenon—has long been a subject of both scholarly scrutiny and public concern. Critics argue such movements foster “regulatory capture,” where regulators may favor future employers by being lenient or by enacting favorable regulations. Conversely, proponents suggest the promise of private-sector employment can incentivize highly competent individuals to take on regulatory roles, where they may be motivated to enhance their expertise and build credibility.

This paper seeks to empirically assess the career paths of senior federal regulators, examining the factors that drive revolving-door transitions and the subsequent consequences for both career advancement and regulatory practices. In particular, the study aims to uncover the underlying motivations for such transitions and evaluate their impact on regulatory outcomes, focusing on how regulators’ movements between sectors influence both their careers and the regulatory environment.

Data and Methodology

This study assembles an extensive dataset covering the career histories of approximately 500 senior federal regulators who headed any of the 50 executive branch agencies responsible for issuing enforcement fines between 2000 and 2022. The data span their entire careers, from college graduation to their work in both public and private sectors. The researchers draw from diverse sources, including Congressional hearing transcripts, LinkedIn profiles, BoardEx, Wikipedia, and corporate websites, ensuring comprehensive coverage of the regulators’ career trajectories while minimizing selection bias.

To examine the regulatory activities of these individuals, the study introduces novel metrics for regulatory intensity, enforcement (using the Violation Tracker database), and complexity (based on textual analysis of Federal Register rules). It also develops measures of private-sector employment, job seniority, and wealth accumulation (using Lexis Nexis Public Records for real estate data). The study applies a combination of statistical techniques, including regression analysis with fixed effects, and machine-learning methods, such as a fine-tuned Legal BERT model, to assess the correlations between revolving-door movements, career outcomes, and regulatory behaviors.

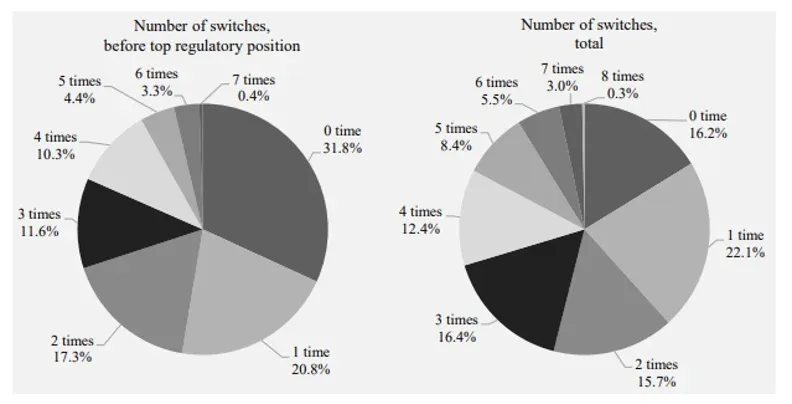

Figure 1 Movement between the Private and Public Sectors

Note: This figure reports the distribution of the number of moves between the private and public sectors throughout a regulator’s career. Number of switches, before top regulatory position is the number of switches between the private and public sectors before taking the top regulatory position. Number of switches, total is the number of switches between the private and public sectors over the regulator’s entire career, including the period after stepping down from the top regulatory position. The sample includes 1,338 top federal regulators from 50 executive branch agencies during the 2000–2022 period.

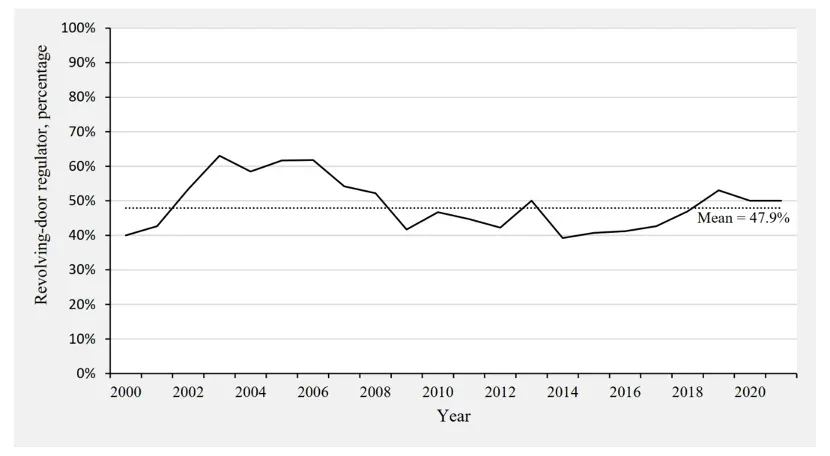

Figure 2 Percentage of Revolving-Door Regulators over Time

Note: This figure plots the annual proportion of revolving-door regulators among all sample top federal regulators. Revolving-door regulator is an indicator that equals 1 for regulators who worked in the private sector more than six consecutive months before and after their top regulatory position. The sample includes 1,338 top federal regulators from 50 executive branch agencies during the period 2000-2022.

Findings and Discussion

This research uncovers several critical insights into the revolving-door phenomenon. First, it shows movement between the public and private sectors is a prevalent and persistent feature of senior regulators’ careers. A significant proportion of regulators have prior private-sector experience before entering regulatory roles, and many engage in multiple transitions between the two sectors throughout their careers. The study also reveals political factors play a substantial role in regulatory transitions. In particular, regulatory transitions are more likely to occur when the party of the president changes, and the party affiliation of regulators influences the direction of these moves.

The study also finds revolving-door regulators tend to engage in more regulatory activities and enforce rules more strictly than their non-revolving-door counterparts. These regulators oversee a greater number and complexity of regulatory rules, issue more enforcement actions, and manage more intricate regulatory environments. This finding challenges the “regulatory capture” hypothesis, which would predict more lenient oversight or inaction, and instead supports the “bureaucratic capital” hypothesis, suggesting revolving-door regulators actively seek to enhance their competence and reputation in anticipation of future private-sector roles.

Additionally, the research sheds light on the career trajectories and financial outcomes of revolving-door regulators. Despite often coming from less affluent backgrounds, these regulators tend to accumulate significant wealth, particularly in real estate. The study further reveals that those who engage in multiple transitions between sectors are more likely to secure senior positions in private firms, emphasizing the career advantages that cross-sector experience can provide. Economic recessions also influence these trajectories, with individuals more likely to begin their careers in the public sector during downturns, and recession-era entrants being more likely to engage in revolving-door movements and accrue wealth over time.

Policy or Market Implications

The prevalence of the revolving door has several important implications for both policy and the functioning of markets. The finding that revolving-door regulators are more active and enforce regulations more strictly challenges the idea that regulatory capture leads to inaction. Instead, it suggests the prospect of future private-sector opportunities may incentivize regulators to be more engaged and to demonstrate their capabilities through active regulation and enforcement. The increased complexity of regulations overseen by revolving-door regulators could also be interpreted through the lens of “bureaucratic capital,” whereby regulators enhance their value to future employers by contributing to complex regulatory environments.

The study also highlights the benefits of experience in both the public and private sectors, which seems to provide a significant career advantage. The intertwining of these sectors may have implications for the flow of talent and expertise between government and industry. Further, the correlation between political cycles and revolving-door movements underscores the potential for partisan influences on regulatory agencies and raises questions about the impartiality of regulatory processes.

From a policy perspective, understanding the incentives that drive revolving-door regulators—whether focused on building competence or bureaucratic capital—is crucial for designing effective regulatory frameworks. Ensuring that regulations governing post-government employment strike an appropriate balance between harnessing cross-sector experience and mitigating potential conflicts of interest could be essential for maintaining public trust and promoting effective regulation.