HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Haishi Li

The Hidden Costs of Anti-dumping Tariffs: What Brazil’s Experience Teaches Us about Employment and Trade Protection

Mar 20. 2025

Key Takeaways

- This study delves into the complex labor market implications of anti-dumping (AD) tariffs along the supply chains, focusing on Brazil’s experience over three decades.

- Main Findings

- Protected Sectors: AD tariffs boost employment within protected sectors but at a high welfare cost.

- Downstream Sectors: These tariffs harm downstream industries, leading to job losses and reduced economic activity.

- General Equilibrium Impact: While protection may appear beneficial for certain industries, the broader economy bears the cost, with a 2.4% welfare loss.

Source Publication:

Haishi Li (2025). The Employment Consequences of Anti-Dumping Tariffs: Lessons from Brazil. SSRN Working Paper.

Introduction: Examining the Ripple Effects of Protectionist Measures

Anti-dumping (AD) tariffs, designed to protect domestic industries from foreign competition, are often viewed as a simple solution to safeguard jobs and stabilize markets. However, their broader implications—especially on labor markets—are far more intricate. While AD tariffs may protect jobs in certain sectors, they disrupt the interconnected web of industries that rely on imports for production.

This study focuses on Brazil’s AD tariff policy, exploring how these trade protections impact employment across various sectors, from directly protected industries to upstream and downstream firms. In addition to traditional analyses, the authors incorporate a comprehensive general equilibrium model to capture the full scope of these effects.

Method

To accurately measure the employment effects of AD tariffs, the authors employ a robust econometric strategy. By using firm-level data, trade information, and a series of fixed-effects regression models, they are able to isolate the impact of AD tariffs from other external economic shocks.

However, the complexity of trade policies necessitates more than just standard regressions. The authors tackle the issue of endogeneity—the fact that tariffs tend to be imposed on industries already exhibiting certain trends—by using an innovative instrumental variable approach, where AD tariffs imposed by other countries serve as instruments for Brazil’s own tariff impositions. This methodological rigor ensures the estimates reflect the true causal effect of AD tariffs on employment.

Key Findings: The Unequal Impact of Protectionism

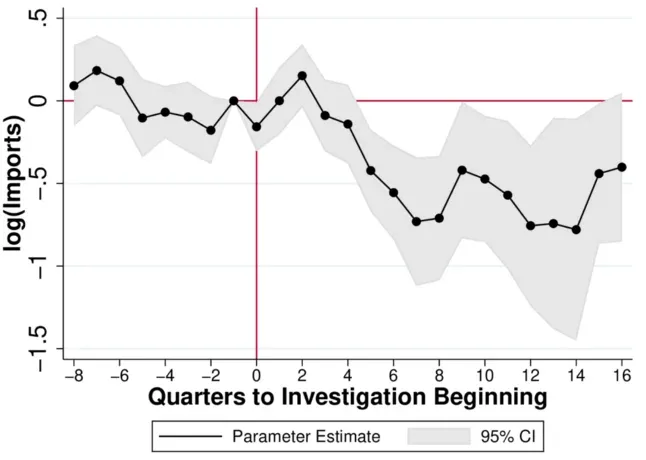

The study begins by examining the direct impact of AD tariffs on imports and international trade. As expected, these tariffs significantly reduce the quantity and value of imports, disrupting international trade flows. However, the effect on import prices is less pronounced, indicating that although tariffs can curtail trade volumes, they do not immediately lead to a drastic increase in prices within the market. This finding highlights that AD tariffs primarily affect trade quantities without significantly altering market dynamics in terms of price levels in the short term.

Figure 1: Effect of AD Tariffs on Imports

Description: This figure contains the coefficients of the effect of AD tariff on imports using the dynamic model 2 plotted against quarters at the beginning of the investigation on the x-axis. Imports are measured in freight on board (FOB) current dollars at the NCM product-code level. Import data are from the Secretary of International Trade of the Ministry of Economy, and AD data are from the Global Anti-dumping Database. The sample is composed of product-origin that had at least one AD investigation. The shaded area contains the 95% confidence interval. Standard errors are clustered at the product-origin level.

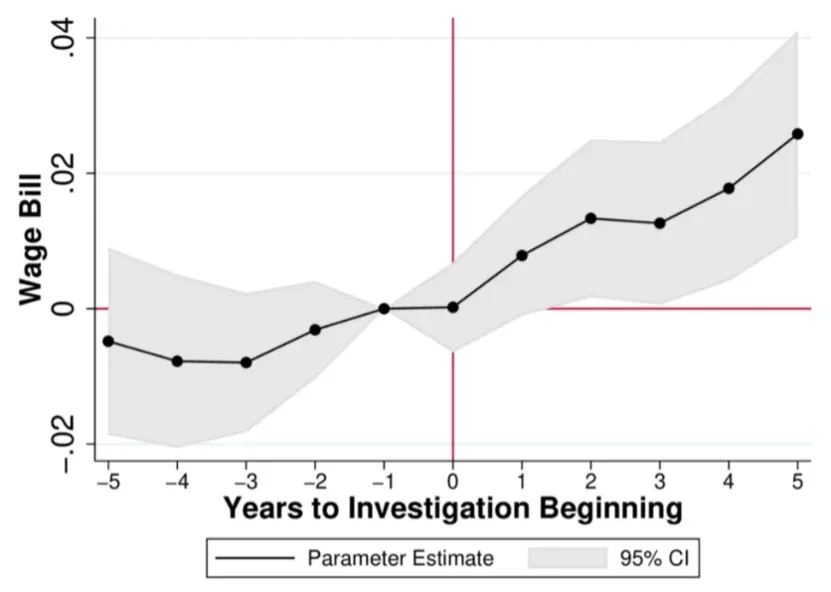

Next, the research highlights the effects on sectors directly protected by AD tariffs. These industries are the most immediate beneficiaries, seeing a significant increase in both employment and wage bills. As tariffs reduce competition, firms within these sectors experience higher output and greater demand for labor. Although this response creates a boost to employment in protected sectors, it masks the negative repercussions for other parts of the economy. The study suggests the employment gains in these industries are not unmitigated successes, because they are offset by losses in other sectors.

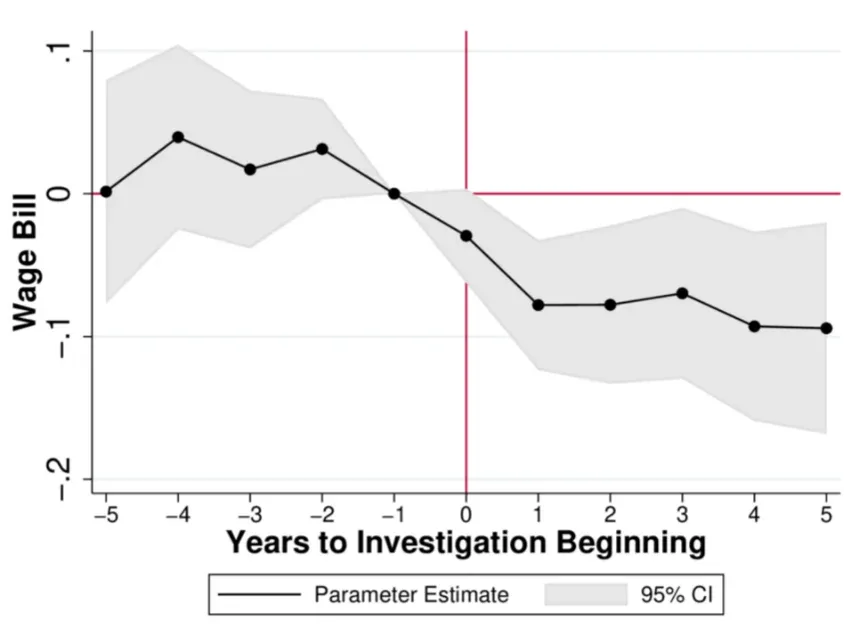

The impact on downstream industries, those that rely on imported inputs, emerges as a hidden cost of AD tariffs. These sectors experience higher input costs, which in turn leads to employment reductions and a decrease in wage bills. This negative spillover effect underscores the broader costs of protectionism, particularly for industries that depend on foreign materials and goods. The data clearly show firms in downstream industries struggle to maintain their workforce as their input costs rise due to the imposed tariffs.

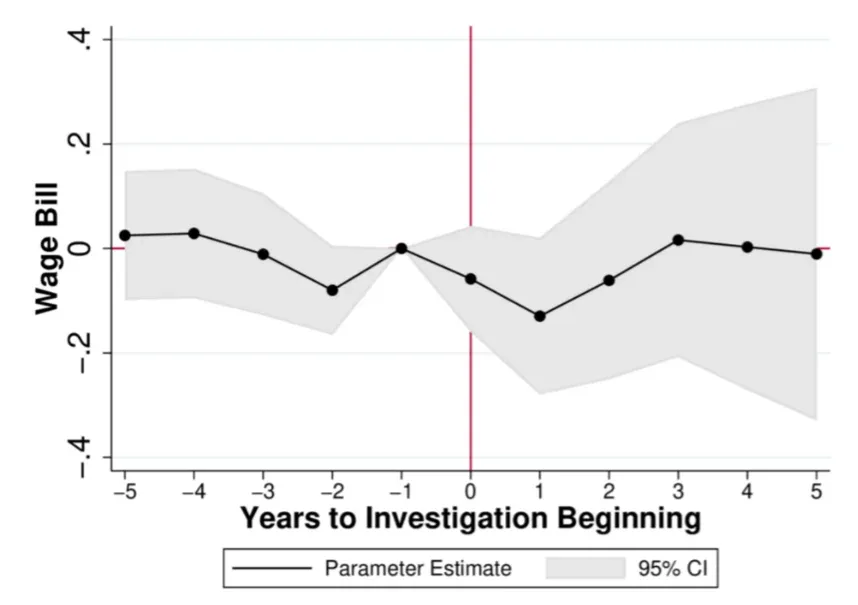

By contrast, the effects on upstream industries, which supply raw materials to the protected sectors, are more ambiguous. Some models suggest wages in these sectors might rise due to higher demand for their products, but these results are not consistent across all models. This finding suggests that although certain upstream industries might benefit from a protected downstream sector, these benefits are not uniform and depend on factors specific to each industry.

Figure 2: Effect of AD Tariffs on Wage Bill

(a) Midstream Wage Bill

(b) Downstream Wage Bill

(c) Upstream Wage Bill

Description: This figure contains the coefficients of the effect of an AD tariff on the log wage bill using the dynamic model. The x-axis contains the number of years to the first AD investigation. Wage-bill data are from RAIS, and AD data are from the Global Anti-dumping Database. The sample is composed of firms in sectors producing the product under AD investigation. We constrain the sample to the set of firms observed five years around the AD investigation. These sample restrictions are made to avoid compositional change. The shaded area contains the 95% confidence interval. Standard errors are clustered at the firm level.

The research also delves into the broader welfare effects of AD tariffs by using a general equilibrium model. This model simulates the interconnectedness of various sectors and labor markets, offering a more comprehensive view of the tariffs’ overall economic impact. The study reveals that although protected sectors see short-term gains, they come at a significant cost to the broader economy. The general equilibrium analysis estimates a 2.4% welfare loss across Brazil’s economy, suggesting that although some sectors may benefit, the national economy suffers due to the negative spillover effects in other industries.

Finally, the study examines regional disparities in employment effects. Regions that are heavily concentrated in protected industries see some positive impacts on job growth. However, the uneven distribution of these benefits highlights the regional disparities that come with protectionist policies. These findings suggest the costs and benefits of AD tariffs are not evenly distributed across Brazil, and certain regions may bear the brunt of the economic costs.

Policy Implications: Rethinking Protectionism

The findings of this study offer valuable lessons for policymakers considering the use of AD tariffs or other protectionist measures. Although these tariffs may provide short-term benefits to the sectors they protect, the broader economic costs must not be overlooked.

First, the study highlights the trade-off between short-term gains and long-term costs. Although AD tariffs lead to employment gains in protected sectors, these benefits come at the expense of downstream industries, which face higher costs and reduced employment. The 2.4% welfare loss suggests protectionism, although potentially beneficial to specific industries, may be a costly strategy in the long run.

Second, the research underscores the need for policymakers to consider the unequal distribution of the effects of protectionism. While some sectors and regions may benefit, others may experience significant losses. A more targeted approach to trade policy could help minimize these disparities, ensuring the economic benefits of protectionism are more evenly distributed.

Finally, the study reminds policymakers the employment gains in protected sectors are part of a larger economic puzzle. Protectionist measures should be assessed not just in terms of their immediate effects on specific industries, but also in the context of their broader impact on intersectoral linkages and overall economic welfare. To make informed decisions, considering how protectionist policies ripple across the economy and affect different regions and industries is essential.