HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Philipp Krueger | Zacharias Sautner | Dragon Yongjun Tang | Rui Zhong

The Effects of Mandatory ESG Disclosure Around the World

Apr 14, 2025

Key Takeaways

- This study explores how mandatory ESG disclosure affects firm-level stock liquidity, focusing on the roles of government versus stock exchange mandates and the influence of informal institutions.

- The study finds mandatory ESG disclosure improves stock liquidity at the firm level.

- ESG disclosure regulations are more effective when implemented by government institutions rather than stock exchanges. This finding suggests government-led mandates have a greater impact on stock liquidity.

- Full compliance with disclosure regulations is more beneficial than a “comply-or-explain” approach. Stricter enforcement of compliance leads to stronger improvements in market transparency.

- Informal institutions, such as societal norms, further amplify the positive effects of mandatory ESG disclosure. The study shows these norms play a key role in enhancing the liquidity benefits of ESG regulations.

Source Publication:

Krueger, Philipp, Sautner, Zacharias, Tang, Dragon Yongjun, and Zhong, Rui. “The Effects of Mandatory ESG Disclosure around the World.” Journal of Accounting Research, October 2024.

Background and Research Question

In recent years, mandatory ESG (environmental, social, and governance) disclosure has become a focal point for policymakers and regulators, driven by the growing demand for transparency in corporate sustainability practices. ESG disclosure is seen as a critical mechanism for improving market efficiency and enabling investors to make better-informed decisions. However, the actual impact of these regulations on firm-level outcomes, particularly stock liquidity, is the subject of ongoing debate.

The effects of mandatory ESG disclosure on stock liquidity are theoretically ambiguous. One view suggests such mandates reduce information asymmetry about firms’ ESG-related risks and financial implications, mitigating adverse selection and improving market liquidity. By increasing transparency on both firms’ “value” (impact on risks and cash flow) and “values” (alignment with investor preferences), ESG disclosure should facilitate trading.

However, another perspective argues these benefits may not materialize. ESG disclosures are often broad, qualitative, and unstructured, making them difficult for investors to interpret. If the disclosed information lacks financial materiality or if demand for values-based data is low, liquidity improvements could be minimal. Additionally, firms with existing voluntary ESG reporting may experience little added impact from mandatory rules. The lack of standardized reporting frameworks could further limit effectiveness.

The impact of mandatory disclosure might also depend on the initial transparency of firms. If firms already operate in well-informed markets, the impact of mandatory disclosure may be weaker. Moreover, more precise ESG disclosures could even reduce liquidity if ESG-focused investors interpret and act on the information differently from traditional investors.

Against this backdrop, the authors of this study aim to answer a central question: How do mandatory ESG disclosure regulations affect stock liquidity, and what factors influence the extent of their impact?

This inquiry is significant because stock liquidity is a crucial indicator of market efficiency. Liquidity, reflecting how easily assets can be bought or sold without affecting their price, is essential for functioning capital markets. This research explores the nuances of ESG disclosure mandates across various countries, considering government enforcement, compliance mechanisms, and the role of societal norms in shaping market responses.

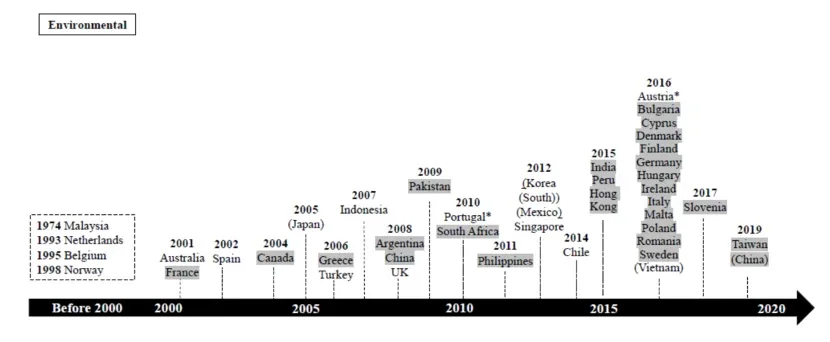

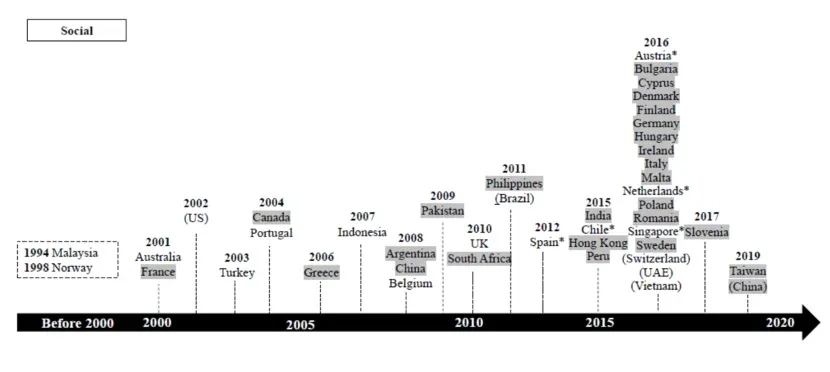

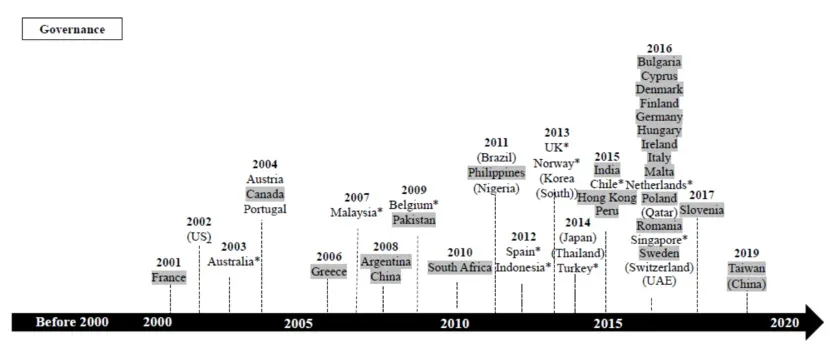

Figure 1 Timelines of the introduction of mandatory ESG disclosure regulations around the world

Panel A: Introduction of Mandatory E Disclosure

Panel B: Introduction of Mandatory S Disclosure

Panel C: Introduction of Mandatory G Disclosure

Note: This figure exhibits the timeline of the introduction of mandatory environmental (Panel A), social (Panel B), and governance (Panel C) disclosure around the world during our sample period. France (shaded country name) indicates sample countries that implemented mandatory E, S, and G disclosure all at once. The remaining countries implemented mandatory disclosure gradually one by one. (Japan) (country name in brackets) indicates sample countries that did not implement mandatory ESG disclosure on all three topics during the sample period. Australia* (country name with asterisk) indicates the last of the three disclosure types (E, S, or G) is introduced. Estonia (2017) and Slovakia (2015) introduced mandatory ESG disclosure, but neither country is listed in the figures, because they are not included in the regression sample, due to missing data.

Methodology

To rigorously test the impact of mandatory ESG disclosure on stock liquidity, the authors utilize a staggered difference-in-differences model, applying a global dataset that spans several countries and regulatory environments. This methodology allows the authors to isolate the causal effect of mandatory ESG disclosure by comparing firms subjected to these mandates with those not affected, controlling for firm-specific and country-level factors.

Key liquidity proxies such as the bid-ask spread, price impact, and zero return are examined, alongside an aggregate measure of liquidity known as the illiquidity factor. This approach ensures the analysis captures various dimensions of stock liquidity while accounting for other potential influences on market behavior.

Findings

The study offers compelling evidence that mandatory ESG disclosure regulations lead to significant improvements in stock liquidity. The effects are strongest when the mandates are enforced by government institutions rather than stock exchanges, and when firms are required to fully comply rather than adopt a “comply-or-explain” approach. This finding suggests the enforcement mechanism and the degree of regulatory stringency play a critical role in determining the effectiveness of ESG disclosure mandates.

A particularly notable finding is that firms operating in weaker information environments experience the greatest benefits from mandatory ESG disclosure. These firms, which often face higher levels of information asymmetry, see substantial improvements in stock liquidity as the increased transparency offered by ESG disclosure helps bridge the information gap.

The study also reveals the effectiveness of ESG disclosure is enhanced by informal institutions, such as societal norms and cultural expectations. In countries with stronger environmental and social norms, the positive effects on stock liquidity are more pronounced. The authors argue these informal institutions play a pivotal role in reinforcing the regulatory framework and shaping investor behavior.

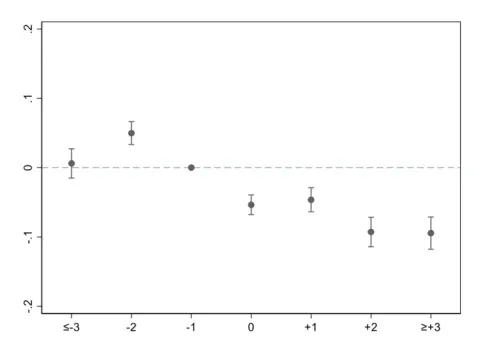

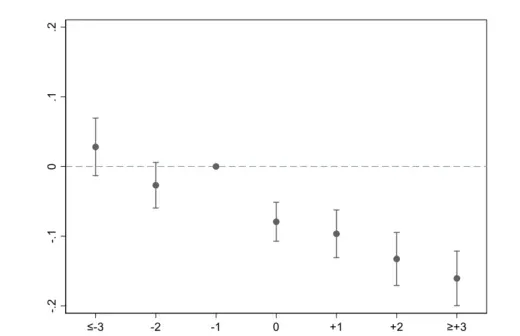

Figure 2 Mandatory ESG disclosure and stock liquidity: Event-time effects

Panel A: Full Sample

Panel B: Exclude Voluntary ESG Disclosure Countries

Note: This figure displays event-time effects of mandatory ESG disclosure on Illiquidity Factori,c,t, which is an aggregate illiquidity factor constructed as the score of a single factor extracted from the three liquidity measures Bid-Ask Spreadi,c,t, Price Impacti,c,t, and Zero Returni,c,t. Year t=-1 acts as the benchmark year. Standard errors are clustered at the firm level. The figure plots the coefficient estimates for each event-time year together with 99% confidence intervals.

Implications

The implications of this study are far-reaching for policymakers and market participants. The findings underscore the importance of mandatory ESG disclosure regulations in improving market efficiency, particularly through the enhancement of stock liquidity. To maximize their impact, policymakers should prioritize the design of disclosure mandates that are enforced by government institutions, require full compliance, and align with societal norms.

For investors, the study highlights the potential benefits of ESG disclosure mandates in reducing transaction costs and improving market depth. By promoting transparency and reducing information asymmetry, these regulations can help foster more efficient and liquid capital markets.

Moreover, the results suggest firms with initially weaker information environments stand to gain the most from mandatory ESG disclosure. This finding offers an opportunity for regulatory bodies to level the playing field, ensuring firms in less transparent markets are not at a disadvantage.

Finally, the study draws attention to the role of informal institutions in enhancing the effectiveness of ESG disclosure regulations. In countries with stronger social and environmental norms, the benefits of disclosure mandates are amplified. This observation highlights the importance of fostering a culture of sustainability and transparency to maximize the impact of these regulatory measures.