HKU Jockey Club Enterprise Sustainability Global Research Institute

World-Class Hub for Sustainability

Event Recap:

Collaborative Efforts to Accelerate Transformation:

How Finance Can Boost Sustainable Development in Southeast Asia

Collaborative Efforts to Accelerate Transformation: How Finance Can Boost Sustainable Development in Southeast Asia

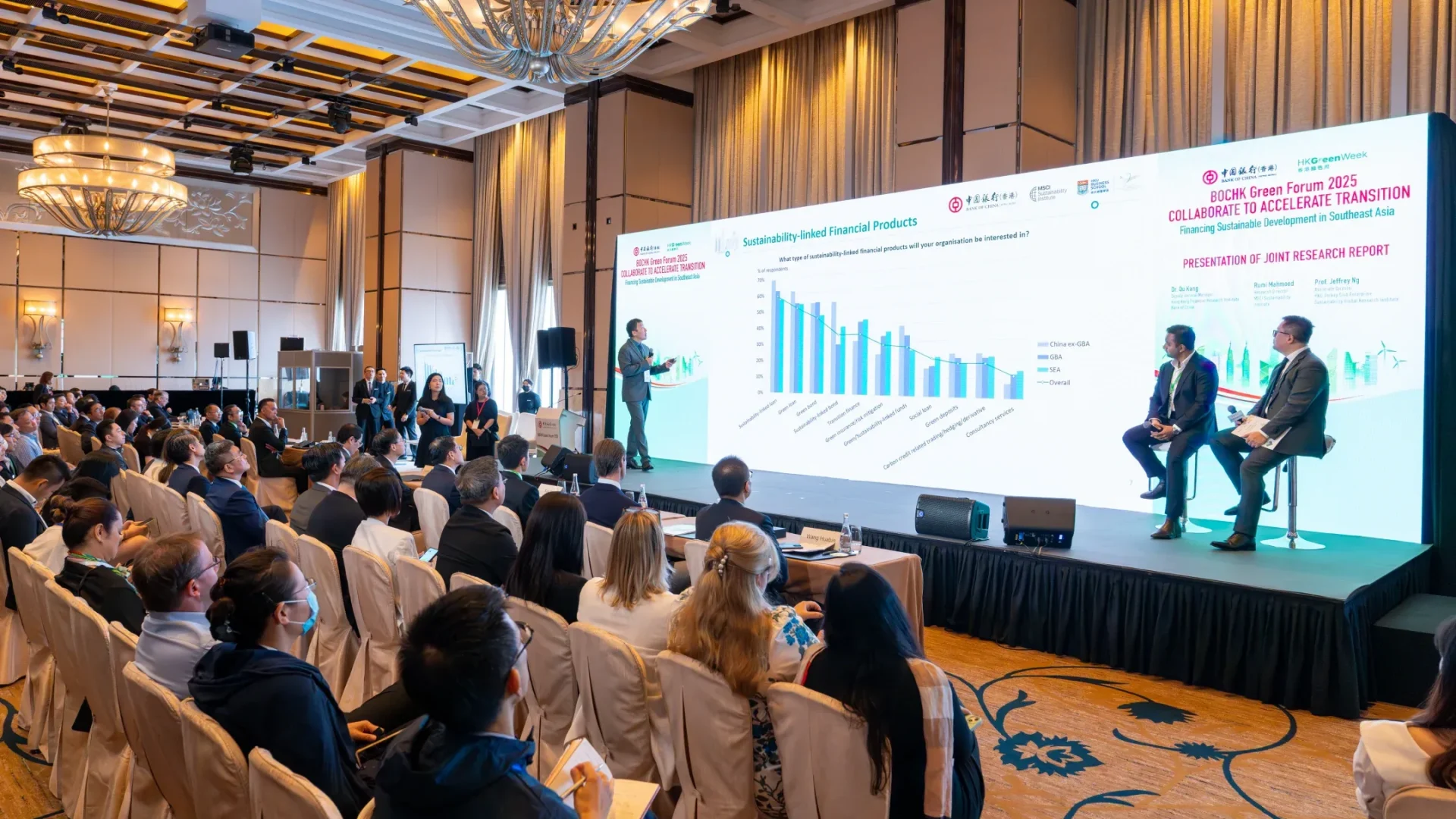

On September 9, Bank of China (Hong Kong) hosted “Collaborate to Accelerate Transition: Financing Sustainable Development in SEA” in Hong Kong. The event successfully convened leaders from regulatory agencies, financial institutions, corporations, and academia to explore opportunities and challenges in advancing sustainable development across Southeast Asia.

A landmark report, titled “The Asian Way: Sustainable Finance Market Outlook in Southeast Asia (“SEA”) and the Role of Hong Kong” , was officially released during the event. Jointly produced by Hong Kong Financial Research Institute of Bank of China, the MSCI Sustainability Institute and HKU Jockey Club Enterprise Sustainability Global Research Institute, the report analyses the robust demand for sustainable finance in Southeast Asia amidst current supply shortfalls. It further highlights Hong Kong’s critical role as an international financial centre in bridging global capital with regional green initiatives.

Panellists held in-depth discussions on building a sustainable financial ecosystem adapted to regional characteristics through the “Asian way”, and explored how Hong Kong can serve as a “super connector” in facilitating this process.

Report Takeaways

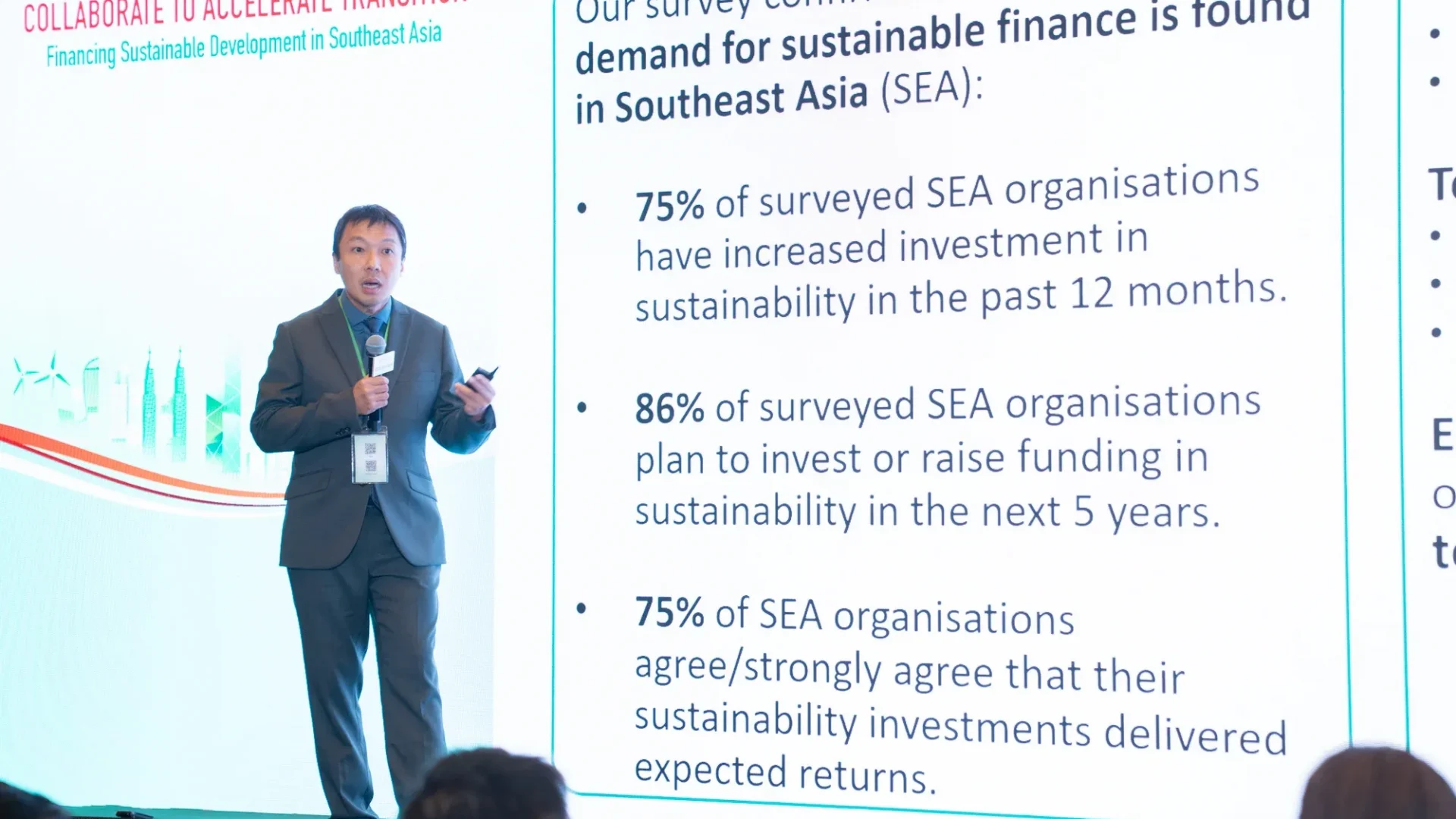

Through an in-depth analysis of survey questionnaires, Professor Jeffrey Ng, Associate Director of the Institute, emphasized in the report:

- Investors demonstrate strong willingness and clear demand. The SEA region exhibits a robust commitment to transformation: 75% of surveyed institutions expanded their sustainable investments over the past year. Looking ahead, 86% of SEA organizations plan to invest in or finance sustainability initiatives over the next five years —well above the 70% average across all respondents. Demand is particularly strong for sustainability-linked loans, green loans, and green bonds.

- Sustainability is increasingly becoming a critical source of corporate value, presenting both opportunities and challenges. A growing number of institutions now regard sustainable development as a strategic opportunity for growth and efficiency improvement, rather than solely a compliance obligation. According to the survey, organizations are increasingly treating sustainability as a driver for business expansion and operational optimization rather than a regulatory requirement. “Business opportunities” (66%) and “cost savings and efficiency gains” (63%) emerged as the top two motivators overall. Across all regions surveyed, the high cost of transition is widely seen as the main barrier, underscoring the practical challenge of balancing upfront investments with anticipated returns.

- Hong Kong’s role as a leading international green finance hub is widely acknowledged. The findings reinforce its strong credibility and prominent standing, underscoring its capacity to set benchmarks, attract capital, and spearhead both regional and global sustainable finance initiatives. Around 70% of respondents recognise Hong Kong as a trusted international green finance centre that can supply their institutions with the required sustainable financial products. This favourable perception remains consistent across regions, emphasizing Hong Kong’s pivotal potential in anchoring sustainable finance development throughout Asia.

- The way forward is clearly outlined. Market expectations for Hong Kong are high, with a particular focus on three priority areas: transition finance frameworks and instruments, a high-integrity carbon market, and tailored investment vehicles designed to address specific regional market gaps. Close to two-thirds of enterprises consider transition finance frameworks a top priority, calling for clear guidance, standardized taxonomies, and blended finance mechanisms to accelerate decarbonization in high-abatement sectors.

Discussion Highlights

During the roundtable discussion, participants examined the differing levels of ESG adoption and emphasis across global markets, noting in particular the sustained momentum and growing enthusiasm for ESG practices in emerging economies—especially across Southeast Asia. The dialogue focused on the key drivers behind this trend. Professor Jeffrey Ng underscored the following points:

- Diverging paths in sustainable development between East and West: In some Western markets, scepticism around ESG has grown, partly due to debates over fairness in social initiatives and the economic disruptions faced by traditional industries and workers during the energy transition. In contrast, Asian markets have adopted a more pragmatic and phased approach to ESG, with greater policy consistency and stronger market engagement.

- Key challenges in sustainability transition: Two major obstacles were emphasized. First, awareness and understanding remain limited, as the benefits of sustainable development are often long-term and less tangible in the short run. Second, the uncertainty between costs and benefits poses a fundamental hurdle—both investors and companies struggle to guarantee that substantial upfront investments will lead to commensurate economic returns.

Professor Ng introduced the concept of “sustainable sustainability,” emphasizing that the process of advancing ESG must itself be sustainable. He advocated for a steady and inclusive pathway, cautioning against overly aggressive approaches, to ensure the enduring alignment of social, environmental, and economic objectives.

Closing Remarks

Through financial innovation, policy support, and strengthened regional collaboration, Hong Kong is reinforcing its position as a green finance hub and increasingly emerging as a pivotal force in optimizing sustainable capital allocation across Asia and advancing global climate governance.

Given the considerable potential for sustainable transformation in Southeast Asia, Hong Kong—as an internationally recognized green finance centre—is strategically positioned to capitalize on emerging opportunities and bolster regional development. Looking ahead, Hong Kong can further deepen cooperation with regional and international partners to collectively accelerate Asia’s transition toward a carbon-neutral future.

Feel free to read the full report here